Solution of the Week: School Choice

In virtually every aspect of life, Nevadans demand choice. They expect a choice of grocers, retailers, food service providers, health care specialists and automobile manufacturers. Choice begets accountability because, in order to attract and retain customers, they must offer a product consumers are willing to pay for.

Yet, in the realm of education — arguably the most significant area of an individual’s life — most Nevadans have been deprived of choice. Instead, they have been forced into a state-run monopoly. The outcome has been predictable: As monopoly educators have been protected from the accountability that choice imposes, Nevada’s K-12 education system has grown ever-more expensive without any commensurate increase in quality. If Nevada’s public school system is to prepare the next generation of Nevadans to compete in a global economy and, hopefully, lead the way into a new era of successful entrepreneurship, then greater accountability will be required. The best means of achieving that is through choice.

It is important to remember that public schools are not necessarily synonymous with a government monopoly on schools. Just as Food 4 Less and Albertson’s serve the public as privately owned grocers, so, too, can private schools play an important role in providing for the public’s education needs by expanding the realm of school choice.

Key Points

Private schools cost less. Nevada’s largest school districts currently spend between $11,000 and $14,000 per pupil when all expenditures are considered. On the other hand, 79 percent of private schools nationwide charge tuition rates of less than $10,000 and 30 percent of private schools charge tuition of less than $3,500.[1]

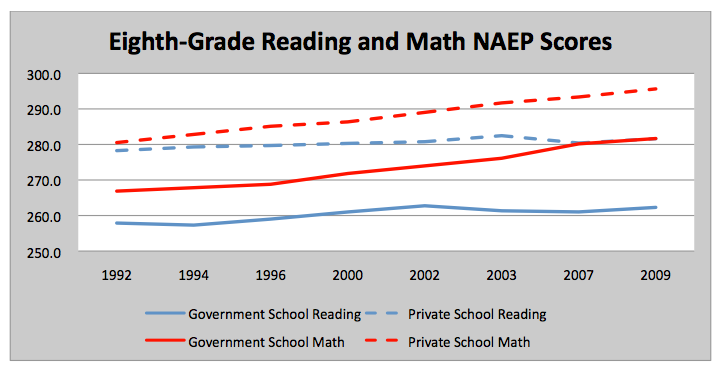

Private schools yield better results. Nationwide, students in private schools score almost two grade levels higher on standardized math and reading tests than do their government-school peers.[2] Also, graduation rates and the likelihood of attending college are far higher among private school students.[3]

Every child can learn. It’s not just the wealthy elite who perform well in private schools. Low-income beneficiaries of school-choice programs in Washington, D.C., Milwaukee, Florida and elsewhere have shown significant improvement after participating in choice programs for only a few years.[4]

Choice improves government schools. Despite opponents’ claims that choice programs “cream” the best students away from government-run schools, empirical evidence shows that the presence of alternatives leads to higher test scores and improved graduation rates even for those who choose to remain in a government school.[5]

Recommendations

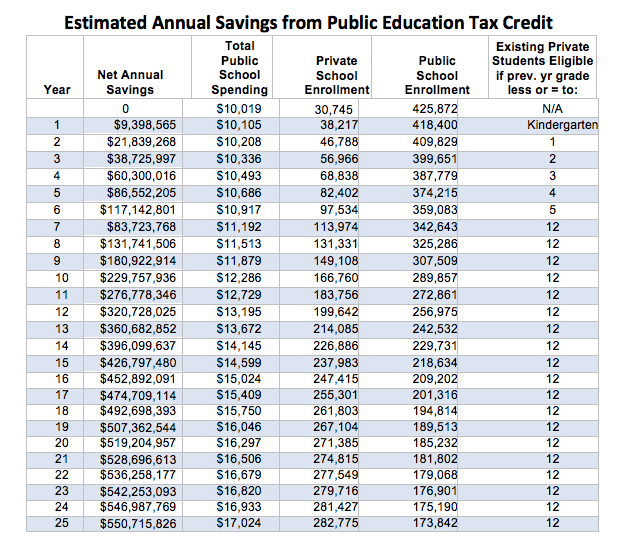

Create a Public Education Tax Credit and scholarship program. Allow businesses facing a tax liability in Nevada — such as the Modified Business Tax or sales tax — to receive a dollar-for-dollar tax credit for donations into a scholarship fund that would finance the educational dreams of Nevada’s children. NPRI has already designed such a plan, which can be found on its website.[6]

Create Educational Savings Accounts. ESAs are private accounts held by individuals from which beneficiaries can make certain approved purchases for educational reasons. These include private-school tuition, online education, textbooks, transportation costs or private tutoring. Arizona became the first state to offer ESAs in 2011, and the idea has since been replicated in Florida. In Arizona, ESAs are available to students enrolled in failing schools and students with special needs. Beneficiaries receive 90 percent of per-student base funding in their ESA, and unspent monies remain in the account to help pay future college tuition costs.

[1] U.S. Department of Education, National Center for Education Statistics, Digest of Education Statistics, 2013.

[2] Ibid.

[3] Ibid.

[4] See, e.g., Greg Forster, Ph.D., “A Win-Win Solution: The Empirical Evidence on School Vouchers,” The Foundation for Educational Choice, 2011.

[5] Ibid.

[6] Andrew Coulson, “Choosing to Save: The Fiscal Impact of Education Tax Credits on the State of Nevada,” Nevada Policy Research Institute, 2009, http://www.npri.org/publications/choosing-to-save.