The industry winners and losers of the Commerce Tax

The Nevada Commerce Tax has treated state industries in a grossly inequitable fashion, according to an analysis of just-released revenue data from the Department of Taxation.

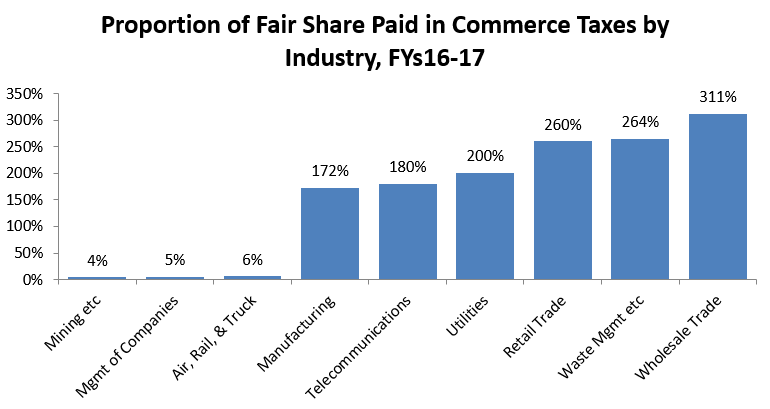

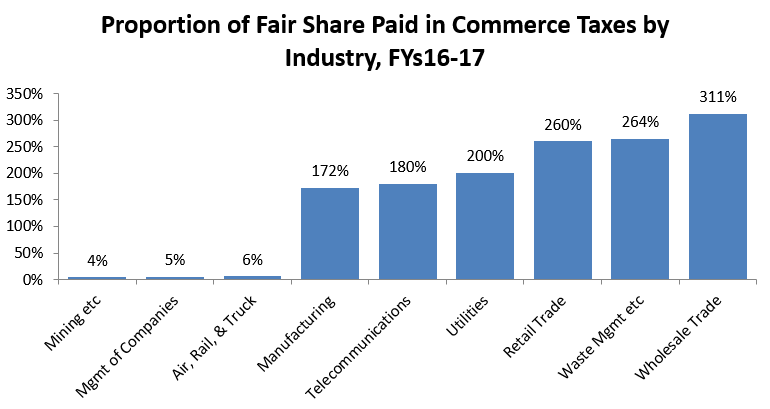

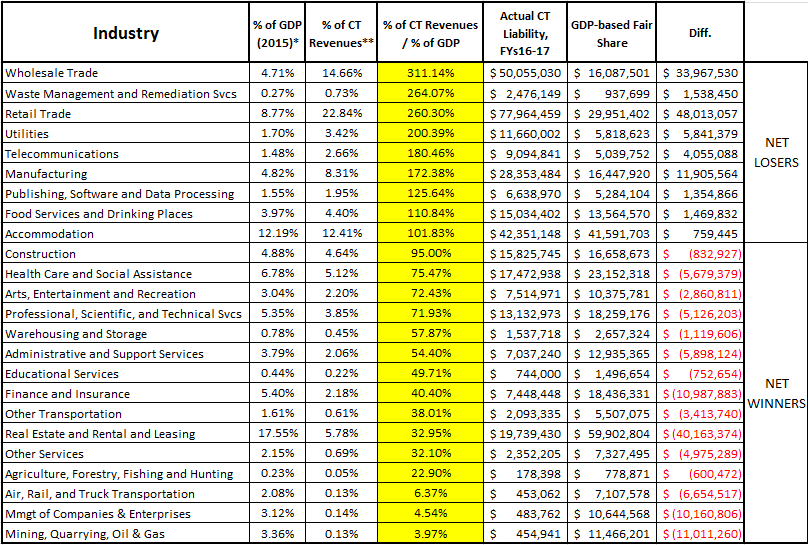

The below chart illustrates each industry’s share of total Nevada Commerce Tax revenues collected over the past two years against that industry’s share of private sector GDP:

The data reveal that certain industries, such as mining, pay only a fraction of their “fair share,” as calculated by their relative contribution to the state’s private sector GDP.

Conversely, industries such as Wholesale Trade and Waste Management pay far more (311 and 264 percent, respectively) than their proportionate share of the state’s economy.

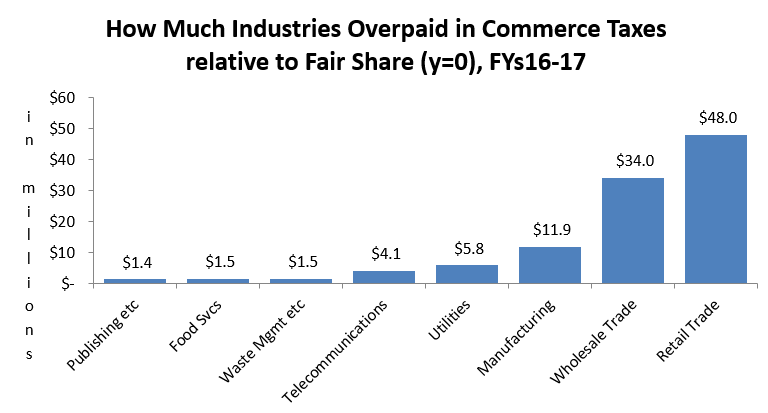

On a nominal basis, the Retail Trade industry was most harmed by the inherent inequity of the Commerce Tax, having overpaid by about $48 million, as illustrated below:

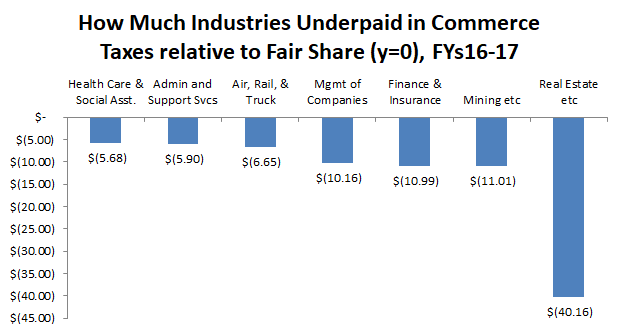

Similarly, the below chart highlights which industries paid significantly less than their proportionate share of the state’s economy:

For Commerce Tax skeptics, this analysis merely reinforces what was commonly understood: That the Commerce Tax ultimately benefits certain industries over others — thus enabling politically-connected industries to effectively lobby against other sectors of the economy.

For complete revenue information regarding which industries overpaid, which underpaid, and the degree to each, see below:

* See https://united-states.reaproject.org/data-tables/gsp-a900n/reports/320000/

** Data provided by Nevada Department of Taxation

More information on the Nevada Commerce Tax is available here, as well as in Solutions: A Sourcebook for Nevada Policymakers, which offers free-market policy solutions to 50+ public policy issues.