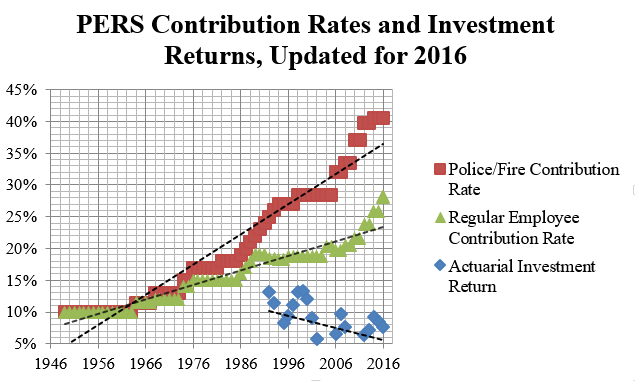

PERS Contribution Rates and Investment Returns Chart

Two years ago, NPRI noted that costs for the Public Employees’ Retirement System of Nevada (PERS) have increased fourfold since inception.

The below chart is an update of that post, which includes data through the fiscal year ending June 30, 2016:

Obviously, the alarming trend has continued unabated. As a result of continued growth in the System’s unfunded liability — now at an all-time high of $13.5 billion — contribution rates for regular employees have risen to 28 percent of payroll, leaving new members “net losers” while also contributing to Nevada’s teacher shortage.

It’s important to note that, for actuarial purposes, the investment returns displayed above reflects a smoothing of gains and losses to mute the impact of any individual year. So while PERS actual investment gain for the 2016 fiscal year was only 2.3 percent, the System reported an actuarial return of 7.7 percent, due to previously unrecognized investment gains.

This leaves PERS with nearly $900 million in unrecognized losses going forward, which will be incrementally absorbed by the System over the next four years. Unless the System outperforms its 8 percent assumed annual rate of return over that time period, debt will rise faster than anticipated, resulting in even higher contribution rates.

To learn more about PERS, please visit http://www.npri.org/issues/detail/pers.