AB99 Testimony (Prevailing Wage)

March 9, 2021

re: Assembly Bill 99 of the 2021 Nevada Legislature

Members of the Assembly Committee on Government Affairs:

Daniel Honchariw, for the record.

Thank you, Asm. Ellison, for your introduction, and thank you, Chairman Flores and Vice Chair Torres, for allowing me to present Assembly Bill 99 on behalf of the Nevada Policy Research Institute.

This is a relatively simple bill to understand, but to begin, I’d like to offer some background information regarding prevailing-wage mandates in Nevada.

Since 1937, Nevada law has required that workers constructing state‐funded public works projects receive a special kind of minimum wage, called “prevailing wage.”

Prevailing wage laws sound like they are intended to ensure that workers receive wages reflective of the local labor market. The Nevada Labor Commissioner, however, administers these laws in a way that ensures trade unions are able to control state-mandated prevailing wage rates.

As former Nevada Labor Commissioner Michael Tanchek wrote to former Governor Jim Gibbons, “State and local government agencies pay more for construction projects than the private sector pays for comparable projects. Saying otherwise would be denying the obvious.”

This is not surprising, because the survey methodology used to compute the prevailing wage is riddled by sampling errors, meaning that the representation of unions among the responses is far higher than among the actual population. For a number of reasons, nonunion contractors incur far higher accounting costs to complete the survey than union contractors.

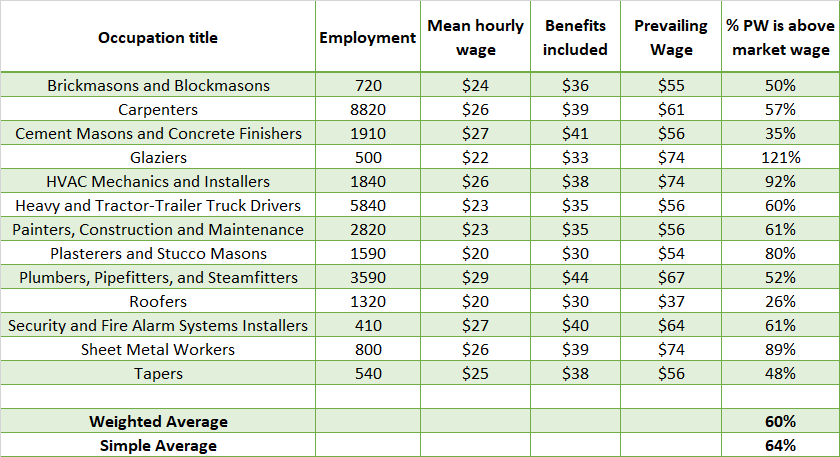

All of this has resulted in hyper-inflated taxpayer costs. NPRI’s most recent analysis, which relies upon 2019 data from the U.S. Bureau of Labor Statistics and the Nevada Labor Commissioner, found that prevailing wages are 60% above the market on a weighted-average basis. Moreover, because the prevailing wage rate also includes the cost of benefits, we increased the average market wage by 50 percent to account for the cost of benefits in the private sector. This is an extremely conservative assumption, meaning that the actual disparity is likely even greater than what is reported here.

Table 1: Average wage and prevailing wage in Clark County, Nevada (2019)

Source: U.S. Bureau of Labor Statistics, 2019; Nevada Labor Commissioner, 2019

In fact, when NPRI last performed a comprehensive analysis totaling the increased costs of such wage premiums across the state, we found that prevailing-wage mandates cost taxpayers nearly $1 billion between 2009 and 2010.

With that background, I’ll reaffirm Asm. Ellison’s primary purpose for bringing forth this bill — to ensure our tax dollars are spent more wisely and go further.

As introduced, AB99 proposes to increase the threshold at which prevailing-wage mandates apply for NSHE construction projects from $100,000 to $250,000, an action which would partially undo the changes made under AB136 (2019). Sections 2 and 3 of this bill illustrate the amendatory language for NRS Chapter 338 required—replacing $100,000 in statute with $250,000. Section 1 merely makes a conforming change.

Section 4 of AB99 asserts that its amendatory provisions will not apply to any construction projects that are awarded before July 1, 2021. As such, AB99 will not invalidate any existing contracts.

Section 5 merely prescribes that this bill would become effective on July 1, 2021, if passed and signed into law.

The conceptual amendment put forth by Asm. Ellison similarly proposes to increase the threshold at which prevailing-wage rates apply — from $100,000 to $250,000 — for rural-county projects. For the same reasons stated by Asm. Ellison, we support this amendment. Quite frankly, NPRI supports the complete abandonment of prevailing-wage laws in Nevada, but marginal progress is progress, nonetheless.

Regarding potential taxpayer savings, it is difficult to provide detailed estimates here (largely because future projects have not yet been contemplated), but the taxpayer costs incurred by modestly increasing prevailing-wage mandates, as with AB136 of 2019, are instructive.

The fiscal notes submitted by NSHE regarding AB136 indicated an $18 million hit over the current biennium, although that bill included two reforms specific to NSHE, so that estimate itself is certainly overstated.

But by simply increasing the proportion of the prevailing wage that applies to school-district construction — from 90% of the prevailing wage, to 100% — AB136 increased school-construction costs for Clark County by tens of millions, according to CCSD’s own fiscal notes.

To conclude, these are not small dollars at stake, and prevailing-wage laws result in our tax dollars being used in unwise and inefficient ways—ways that, for example, seem to impeach any claim that Nevada’s schools are underfunded.

I urge this committee to follow the trend of states which have recently abandoned prevailing-wage laws and adopt these very modest reforms.

Respectfully,