Another billion dollar tax hike to ‘fix’ education?

The Clark County Education Association is lobbying for a $1.4 billion tax hike to increase spending on public education.

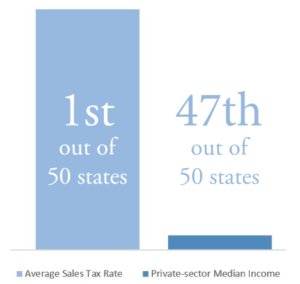

The bulk of this tax hike (more than $1 billion) would come from increasing the state’s sales tax. This would raise Nevada’s average sales tax rate to nearly 10 percent — the highest in the nation.

Here are some quick facts about this proposed tax increase and the current state of education funding in Nevada:

Nevadans can’t afford this tax increase:

- Sales taxes are incredibly regressive — hurting low-and middle-income families the hardest.

- Nevadans already earn less than residents of most other states, ranking 47th in terms of private-sector median earnings.

- This tax increase would require Nevadans to pay a nearly 10 percent average state sales tax rate — the highest in the nation.

More spending does not mean better academic performance:

Nevada’s per-pupil spending levels, at more than $10,000 per student, are already comparable to states that have consistently higher levels of academic performance, such as Arizona, Colorado, Idaho, North Carolina, Tennessee, Texas, Utah and Florida.

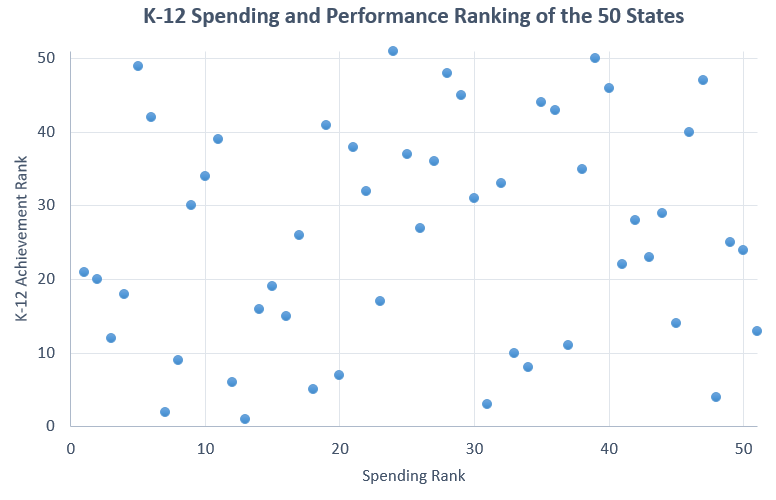

As the scatterplot below illustrates, simply spending more money is no guarantee of improved student learning. Other factors beyond per-pupil spending, such as accountability reforms, performance-based evaluations and educational choice programs, have been empirically proven to increase academic performance — as well as boost other important measures such as college enrollment, civic engagement and parental and student satisfaction.

There are alternatives to hiking taxes:

There are alternatives to hiking taxes:

Rather than forcing Nevadans to pay the nation’s highest average sales tax, lawmakers should instead empower families with greater educational options. Policymakers should ensure students have access to the classrooms that suit their unique needs, rather than simply pouring more money into classrooms that don’t.

In the end, Nevadans deserve an educational system that actually works for students — not merely one that takes more hard-earned money away from working families.

Additional resources:

- Making Nevadans pay the nation’s highest sales tax won’t fix our schools

- Voters should demand bargaining transparency before considering new taxes

- Nation’s leader in school choice dramatically outperforms peers, while spending much less

- Nevada’s education woes reflect a lack of accountability, not insufficient funding

- Lawsuit against state education department needed to protect low-income students