The Nevada Independent badly misleads in recent ‘fact check

The tax reform bill recently passed by Congress is expected to boost middle-income Nevadans’ wages by an average $610 next year.

So why do so many seem to think this coming tax cut is somehow actually a tax increase?

A key reason is the media’s failure to accurately describe the bill or to correct wildly misleading statements coming from partisan opponents.

Take, for example, a recent “Indy Fact Check” that labeled Democratic Rep. Jacky Rosen as “Honest as Abe” — or entirely truthful — when she claimed that “this monstrosity of a bill would eventually slam many of Nevada’s hardworking families with a tax increase while adding more than $1 trillion dollars to our national debt,” and “cause millions to lose their health-care coverage — all so billionaires and giant corporations can receive an unnecessary tax cut.”

While the part about the increase in the national debt is true, Rep. Rosen’s other comments actually range from misleading to simply untrue.

The merit of the journalistic fact-check approach, supposedly, is that it provides a nuanced range of options, rather than just a binary “true or false.”

PolitiFact, for example, applies a “Mostly False” rating to a statement that “contains some element of truth but ignores critical facts that would give a different impression.”

Such a “Mostly False” rating is a perfect fit for Rosen’s depiction of the bill as slamming Nevadans with a tax increase.

The tax increase that Rosen refers to isn’t even provided in the actual bill, but is merely a projection of what would happen — years in the future — if Congress fails to extend the tax cuts the bill puts in place.

In other words, Rosen is focusing on an “increase” that might or might not happen a decade from now, while completely ignoring the fact that, in the meantime, the bill actually lowers taxes for hardworking Nevadans.

Moreover, even if the cuts are allowed to expire after 2025, Nevadan’s aren’t expected to get “slammed” with increases. As even the Nevada Independent itself observed, “The bottom 80 percent of taxpayers are projected to either see a 0.1 percent or no increase in tax rates by 2027.”

One would think this finding would warrant a critical assessment of Rosen’s claim that Nevadans would get slammed with a tax increase, yet the Nevada Independent rated it “Honest as Abe” nonetheless.

According to the Tax Policy Center analysis cited by the Nevada Independent, even if Congress allows the cuts to expire after 2025, the actual amount middle income fliers would get “slammed” with is an average $20 a year increase.

By contrast, that same analysis finds that the bill provides immediate tax cuts of at least $910 a year for the average middle-income filer nationwide until then — an amount 45 times larger than the increase that would occur after the cuts expire.

By entirely ignoring the tax cuts provided in the bill and, instead, focusing on the negligible increase that would occur if Congress fails to make the cuts permanent, many are left with the mistaken impression that the bill raises their taxes.

In reality, the bill provides middle-income filers with nine years of tax cuts that are at least 4,500 percent larger than the projected increase that would occur if Congress allows the cuts to expire in a decade.

Another claim that requires more context is that the bill disproportionately serves the wealthy — which is to say that that those who pay the most taxes benefit more from a tax cut than those who pay much less.

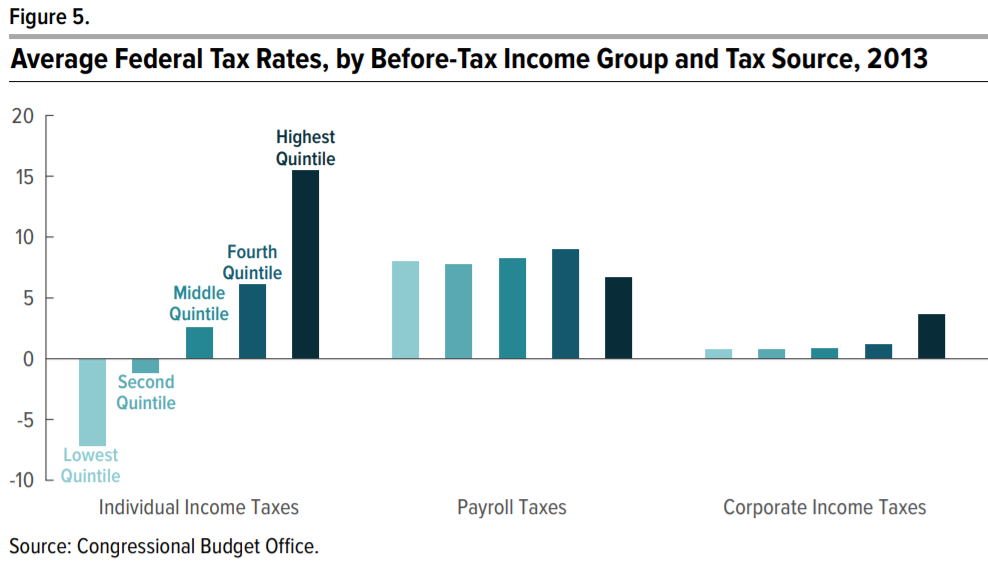

For example, the bottom 40 percent of filers, on net, pay nothing in income taxes and actually receive money back from the federal government — and thus have a negative income tax burden:

And even including the middle quintile, the Tax Policy Center finds that the bottom 60 percent of filers will pay just 2.5 percent of all income taxes in 2019, with the top 20 percent of filers paying 84 percent.

In other words, it is precisely because of the progressive nature of our tax system that the wealthy pay a disproportionately large share of taxes and thus would stand to benefit more from a tax cut than those who, on average, pay much less or nothing at all.

One way to demonstrate this is in total dollar amounts: While the bottom 40 percent of filers paid nothing in income taxes, the middle-income family paid an average of $2,000 annually. Those in the top 20 percent, by comparison, paid an average of $47,000, according to the most recent federal data available from the Congressional Budget Office.

So it’s not difficult to see how the “wealthy” would save larger dollar amounts by comparison, even under a reform that expressly favors the middle-class.

For example, a plan that granted a 100 percent tax cut for middle-income families, and only a 10 percent cut for the highest earners, would still result in the average middle class family receiving less in absolute dollar savings ($2,000) than the amount saved by the wealthy ($4,700).

But would it really be fair to describe a plan that abolishes the income tax entirely for the middle-class, while providing only a 10% cut for the wealthy, as one that favors the wealthy over the middle-class?

That’s why, as opposed to looking at absolute dollar amounts, it’s important to consider what income brackets will see the largest proportional benefit.

When we strip out payroll taxes and look exclusively at the income tax burden — which seems a fair way to assess legislation that primarily affects income taxes — middle-income filers receive a 28% reduction in their effective tax rate, the most of any quintile.

Thus, the legislation actually makes the tax code even more progressive: when measured both in terms of effective tax rates and as a share of the overall income tax burden, the largest cuts go to the middle-class.

Rosen, however, completely omits this important piece of context.

Finally, she asserts that the bill would “cause millions to lose their health-care coverage.” Despite the Nevada Independent rating this claim as entirely truthful, it is again better described as “Mostly False.”

The bill contains no mechanism that revokes health-care coverage from anyone. Currently, federal law penalizes those who do not purchase health insurance. The new tax reform legislation merely removes that penalty.

As such, experts forecast that some of those who currently own health insurance will choose to discontinue their coverage, once they no longer face federal penalties for doing so.

Thus, the expected reduction in coverage alluded to in Rosen’s remarks is not caused by the bill forcing people off their health insurance, but instead by individual families electing to cancel their coverage when given the opportunity to do so.

Obviously, there’s a Grand-Canyon-sized distinction between legislation that forcibly removes health insurance from families, compared to a projection that assumes individuals will voluntarily decide to cancel their existing plans.

By endorsing all of Rosen’s comments as entirely truthful, the Nevada Independent does its readers a disservice: The publication fails to provide crucial context for a complete and accurate representation of what the tax-reform bill actually does.

It appears we now need fact-checkers for the fact-checkers.

Robert Fellner is director of transparency research at the Nevada Policy Research Institute. For more on the tax-reform plan, including links to online calculators which allow you to see how the plan will affect you, click here.