Fuel Revenue Indexing, Clark County

NPRInsight

Data Points: Week of August 8-12, 2016

By Daniel Honchariw

Fuel Revenue Indexing, Clark County

Nevadans already pay the third-highest1 price for unleaded gasoline among all 50 U.S. states.

So what could a “yes” vote on Fuel Revenue Indexing (Clark Co. Ballot Question 5) mean for the average price per gallon for Clark County residents?

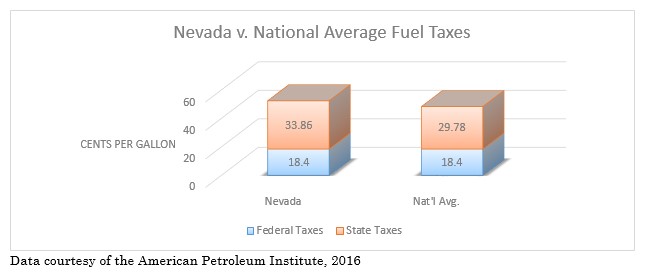

Currently, county residents pay in excess of 52 cents per gallon of unleaded gasoline in combined federal and state taxes.

On average, Nevadans pay four cents more in fuel taxes per gallon than residents in other states.

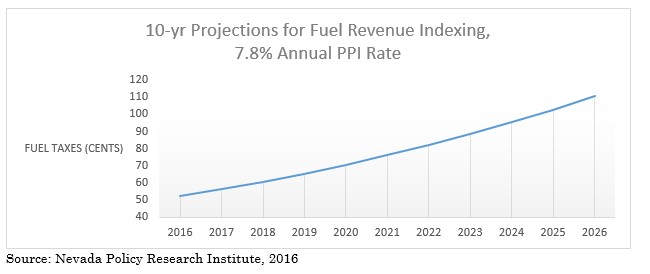

The Fuel Revenue Index measure proposes the current tax level will increase with the rate of inflation as measured by the PPI2, with an annual cap of 7.8 percent, for at least the next ten years.

For fiscal years 2014, 2015 and 2016 the PPI rate was 6.22, 6.05, and 5.25 percent, respectively.

Assuming the maximum permissible rate increase for each of the next ten years, fuel taxes per gallon could increase by 110 percent (58 cents) by January 2027 versus current levels.

As an illustration, the cost per gallon of unleaded gasoline could go from $2.49 to $3.07, an increase of 23 percent versus current price levels.

1. Producer Price Index for Highway and Street Construction

2. Rocio Hernandez, “Nevada still has third-highest gasoline prices in US,” Las Vegas Review-Journal, 9 Aug 2016