Brookings study waves the flag for crony capitalism

The government-funded luminaries at the Brookings Institution have spoken.

And — no surprise — they're recommending their government sponsors be given increased authority to collectivize and "plan" the Silver State's economy.

Secretary of State Ross Miller's office paid Brookings $40,000 to produce a report, called "Unify, Regionalize, Diversify," that advocates a supposed strategy for state economic development — one that would further displace competitive markets, preferred by most people, and instead give the state's political class even more power through collectivized government "venture capital."

The report attempts to provide intellectual justification for two significantly anti-market bills passed by Nevada lawmakers in 2011: AB 449 and SB 75.

AB 449, among other things, creates a "Catalyst Fund" with $10 million in public funds taken from the state's unclaimed-property account. Those millions will be available to appointees of the state's Economic Development Board to either foster expansion of businesses already in the state, or to lure targeted industries to move here. In other words, the Catalyst Fund is a public slush fund that political appointees can dispense to their chums — or would-be chums — in private industry. In classic Nevada style, many of these appointees will, no doubt, later wind up on insider payrolls as "consultants" or the like.

SB 75 creates another slush fund, in the amount of $50 million, within State Treasurer Kate Marshall's office. Additional political insiders are to be appointed to a new state-run venture capital corporation that will purchase direct equity stakes in private firms. To circumvent the Nevada Constitution's clear ban on the state establishing an interest "in the Stock of any company, association, or corporation," lawmakers solicited an opinion from a First District Court judge who rationalized the action with the tenuous "Special Fund Doctrine," arguing lawmakers can get around any constitutional restrictions, if only they first channel public funds into an account outside of the state's general fund.

The Brookings report applauds these maneuvers and proceeds to prescribe the industries that policymakers should force taxpayers to subsidize.

The ostensible purpose of the report is to provide policymakers with a vision for economic development in the Silver State. To its credit, the report does include some valid observations about the particular challenges confronting Nevada: a failing K-12 educational system, a relatively unskilled labor force, high energy costs, and a paucity of research and development for new, commercially viable technologies.

However, failing to recognize the true cause of these problems, the authors propose a flawed plan for overcoming these challenges: placing more resources in the state under political control. Moreover, the authors make numerous invalid assumptions that drive their proposals in the wrong direction:

Claim: "Nevada's core strengths for economic development have traditionally been its overall business-friendly environment, including its low taxes, relatively low costs, low regulations, and ease of starting a business. These advantages will continue to reside at the center of Nevada's value proposition for business investment and economic development moving forward."

Fact: Nowhere do the authors cite any data to support their claim that Nevada has a low-tax environment. This is a huge assumption — and one that is demonstrably false.

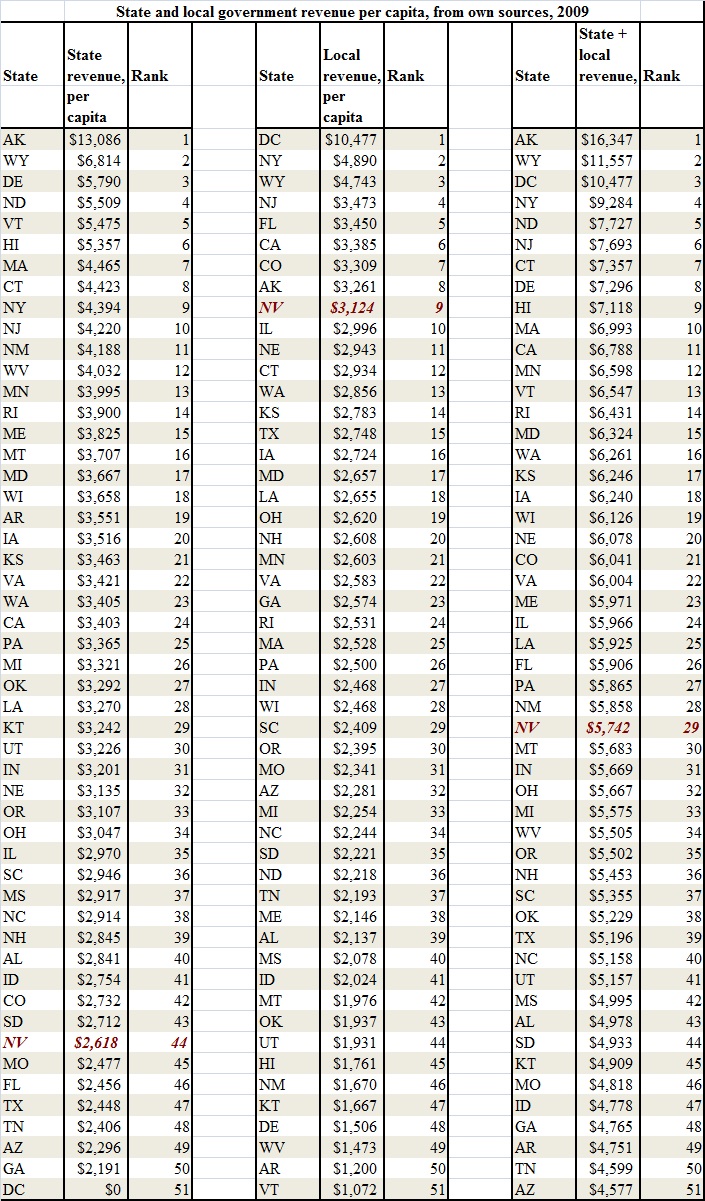

While it is true that state taxes are relatively low in Nevada, local taxes are extremely high. Figures on state and local tax collections from the U.S. Census Bureau do put state revenues per capita (own-source) at 44th highest among the states in 2009. However, local government revenues per capita, on average, were ninth highest among the states. When the entire tax burden is considered — as would any potential investor — Nevadans' per-capita governmental revenue is near the national median, at 29th overall.

Moreover, on a regional basis Nevada's tax environment is not competitive. In four of five neighboring states, the total tax collections are lower than in Nevada. Governments in Oregon, Utah, Idaho and Arizona seize — respectively — $240, $585, $964 and $1,165 less, per capita, than in Nevada. Yet, each of those states boasts higher student test scores and high school graduation rates. In fact, Brookings' own Tax Policy Center prominently displays similar findings for 2008.

Moreover, Nevada lawmakers continually cast the long shadow of prospective future tax increases by pushing every two years for a new corporate-income or gross-receipts tax. As if the state's inability to compete regionally were not enough, state legislators regularly signal potential investors that they can have no certainty about the future tax structure they might face in Nevada.

Claim: A major weakness of the Silver State economy is the "lack of risk capital to invest in startups/innovation." State policymakers should "increase access to risk capital" (along the lines of SB 75).

Fact: One of the most defining features of capital is its mobility. Entrepreneurs pursuing profitable ventures can attract capital from investors anywhere in the world — it need not necessarily come from investors inside Nevada. Most venture capital firms in the United States, for instance, are clustered around New York City.

In fact, the authors explicitly acknowledge and trumpet this feature of capital later on when they call for the state to actively pursue foreign direct investment (FDI). They say, "The state should make FDI an explicit component of Nevada's global engagement policy and use it to build out target clusters." The authors appear not to have considered that, in addition to FDI, equity investment also occurs across state and national boundaries.

Given the worldwide availability of capital for profitable ventures, a much more compelling case can be made for pursuing capital via market demand than for attempting to collectivize capital resources and place them in the hands of local political appointees.

Claim: Nevada's "K-12 educational system is underperforming," which limits the productivity of the labor force. Therefore, policymakers should commit a large amount of new funding to increase K-12 performance.

Fact: It's true that Nevada's K-12 educational system has drastically underperformed. However, as Nevada has nearly tripled inflation-adjusted, per-pupil spending in the last 50 years, this underperformance has little to do with funding levels and almost everything to do with policy design.

In fact, three out of Nevada's five regional neighbors produce dramatically higher student test scores and high school graduation rates while spending significantly less per pupil than Nevada. According to U.S. Department of Education data, per-pupil spending in Nevada was $10,377 in FY 2008, while Arizona, Idaho and Utah spent $9,641, $8,525 and $7,756, respectively.

Claim: "A paucity of innovation activities" contributes to a lack of diversity in the Silver State economy. Moreover, Nevada is threatened by "underinvestment in higher education and [the] lack of a top-tier Carnegie-ranked research university." Therefore, policymakers should "make strategic investments in ‘impact scholars' to boost research output and new discoveries" and commit state dollars to "incentivize university-industry research collaboration."

Fact: Nevada does lack a "top-tier, Carnegie-ranked research university," but the cause, rather than a lack of state funding, is the reverse: Public subsidies ensure some of the lowest in-state tuition rates in the nation. According to data from the U.S. Department of Education, the average cost of in-state tuition and fees to attend a four-year, public university in Nevada was $3,559 for the 2009-10 school year. That amount was the third lowest in the nation, $2,649 below the national median.

This massive government subsidy destroys any competitive marketplace for higher education in Nevada, ensuring that no major private university can take root. Essentially, the low direct costs facing students is a way of ensuring that the state's underperforming higher-ed monopoly can stagger on, unchallenged, with taxpayers forced to subsidize mediocrity. The most successful public universities in the nation — from the University of California, Berkeley to Pennsylvania State University — achieved prominence as a result of competing directly with major private universities nearby. Not coincidentally, these top-ranked public universities also charge tuition rates that are less dramatically subsidized than those found in Nevada.

If lawmakers want to see a top-ranked university in Nevada, which will attract the world's best minds and innovators, then they should decrease — not increase — the level of subsidy.

Claim: Nevada's "energy costs are relatively high for the region" — yet, Nevada should attempt to diversify its jobs base by expanding the production of electricity through "renewable" sources and exporting this electricity to neighboring states.

Fact: A leading reason why Nevadans face high energy costs is the renewable portfolio standard adopted by lawmakers beginning in 1997 that requires electric utility companies in the state to procure a minimum share of their electricity supply from so-called "renewable" sources such as solar panels. Electricity produced through these sources is far more expensive than electricity produced through conventional means, and the U.S. Department of Energy predicts that this will remain true for the foreseeable future. Among new plants entering service in 2016, solar photovoltaic energy is expected to be nearly 3.5 times more expensive than electricity produced from natural gas.

In fact, as the authors point out, "Nevada's demand for solar power has been driven by the state's renewable portfolio standard (RPS), which require [sic] that Nevada utilities get 20 percent of their power from renewable sources by the year 2015 (and then 25 percent by 2025), with at least 6 percent coming from solar energy through 2016-2025." In other words, the demand for these more expensive energy sources is entirely artificial as their profitability depends upon consumers being legislatively compelled to purchase energy from renewable providers.

The authors do not suggest removing the portfolio standard and thus reducing energy costs within the state — while lowering a major input cost for all industries and making Nevada significantly more attractive for investment. Instead, the authors suggest that Nevadans continue to build an entire industry based on the completely artificial demand created by RPS laws in neighboring states — exporting more expensive energy to Californians or Utahans who are statutorily compelled to purchase it. This, the authors conclude, would help to stabilize the Silver State economy, making it less prone to business-cycle volatility.

However, if Nevadans build such an export-oriented renewable-energy infrastructure, they'll place themselves entirely at the mercy of neighboring states' politicians. And at the moment electric ratepayers in California become unwilling to subsidize Nevada's renewable-energy boondoggle — and demand their lawmakers exit the RPS scheme — Nevada's renewable industry will collapse overnight. As thousands of workers are displaced, the fallacy of building an industry based entirely on artificial demand will become immediately apparent to everyone.

Brookings' effort is not the roadmap to economic diversification that Nevadans need. If the state is to build a diverse and sustainable economy, it will only come through human action in competitive markets.

Claim: "To formalize and institutionalize a steady relationship with regional and industry leaders so as to advance regional sector and cluster strategies and continually get things done" policymakers should appoint "sector champions."

"These champions or product managers will serve as both the state's emissaries to the target sectors or clusters and, conversely, the target industries' key ‘go-to' contacts and advocates in state government. Along these lines, the champions would as a first order of business spearhead further organizing work, but they would do more. As the sectors' appointed champions, these professionals would work relentlessly — one with each target industry — to identify and respond to key cluster opportunities as well as binding constraints, especially in state policy and process. With those opportunities in constraints in their sights, the champions would work to seize the opportunities and to work through the policy constraints that impede growth. On the one hand, they might coordinate a targeted business attraction effort to complete a regional supply chain. On the other hand, they might drive a needed regulatory tweak with likely benefits to a prized cluster. In all, the champions will ensure that the state's strategic industries in the regions have not just a direct line into state government but a dedicated, focused, and action-oriented point person waking up each day focused on driving the industry forward."

Fact: With this recommendation, the authors openly promote crony capitalism — and, remarkably, an explicitly corporatist variant last seen in Italian fascism — as a model of economic development. Politically favored industries would receive preferential government treatment vis-à-vis all other economic actors, with their own publicly sanctified lobbyists within state government.

This is a recipe for even more politicization of the Silver State economy, in which politicians instead of consumers in the marketplace will have the power to determine which industries will succeed or fail — and at whose expense.

Such "direct line[s] into state government," driving "regulatory tweak[s]," would institutionalize an atmosphere rich and fruitful for corruption.

Instead of focusing on the many ways government and Nevada's most powerful special interests have long fought the natural diversification of Nevada's economy, "Unify, Regionalize, Diversify" urges lawmakers to pick economic winners and losers. It is a roadmap for crony capitalism — not for successful economic development.

Nevada's citizens and lawmakers should reject the report's underlying premise — that government does a better job running the economy than individuals working in a free-market system — and most of its recommendations.

Geoffrey Lawrence is the deputy policy director of the Nevada Policy Research Institute. For more information visit http://npri.org.