Diversification’s unhappy history: Part IV

From at least the mid-1980s onward, the Nevada Resort Association has repeatedly pushed for policies that would discourage new businesses from entering the state.

While the NRA deployed different arguments, a favorite for gaming-industry strategists focused on the Silver State's fast-growing population. The argument the strategists constructed would be repeated by gaming lobbyists at every opportunity for years. The argument had two premises:

- Growth doesn't pay for itself.

- Non-gaming businesses don't pay their "fair share."

Both assertions had fatal weaknesses but, as the gamers had expected, were music to the ears of Nevada's power-seeking politicians. They loved the conclusion the premises led to: Taxes should be raised on non-gaming businesses. Happily jumping on board the campaign, pols and their government-union backers began beating their tax-raising drums and calculating where to spend the new loot.

However, there was still the little matter of reality: Were the assertions true?

Both of them are based on an NRA-commissioned study titled "The Fiscal Impact of Population Growth in Nevada," which featured the repeated complaint — still made on the NRA website today — that taxes paid by the gaming industry are not proportionate to its number of employees.

As the executive summary of a 2000 re-issue of the paper put it:

The current tax structure in Nevada requires the gaming industry and its employees to pay more than their share of state taxes based on employment.

But the complaint itself is highly peculiar. Since when are taxes proportionate to a firm's number of employees? Normally, a firm's taxes are determined by some measure of income. Or — in the case of industries that impose high costs on other segments of society — policymakers may try to proportion taxes to the externalized costs. The NRA, instead, appeared to be implicitly asking for a tax structure that ignored income, ignored social costs and penalized the creation of jobs.

Explicitly, of course, the NRA paper said no such thing. Instead, it simply argued that because gaming paid "53 percent of state taxes" and the gaming industry "constitutes only 21 percent of the employed work force," gaming had to be paying for state services that were supporting the non-gaming businesses moving into Nevada.

That was the proposition that the state Commission on Economic Diversification's REMI study set out to investigate.

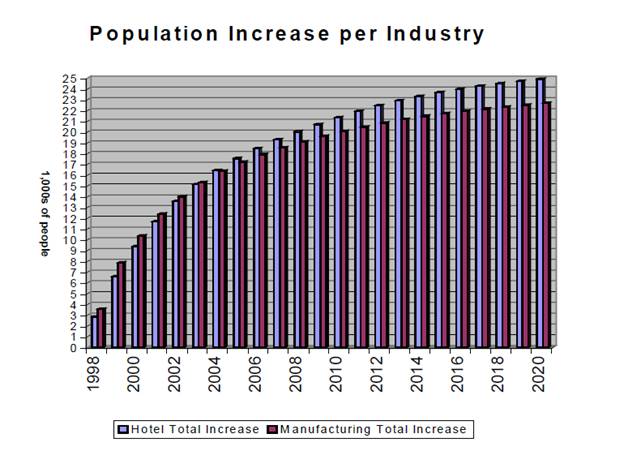

Utilizing a detailed econometric model of the Nevada economy, CED researchers ran tests to compare the results when that economy was "shocked" by the introduction of 8,000 new employees — first in the gaming-hotel sector, and then in the manufacturing sector. The CED then inspected the full range of externalized costs and benefits.

Very tactfully and obliquely, the CED's eventual report suggested that NRA consultants had gotten to their desired conclusion by ignoring the "differences among direct, indirect and induced jobs," which "are critical in understanding the overall economic impact of primary new jobs":

If an industry is attempting to demonstrate the impact of direct jobs, then only the revenue stream associated with direct jobs should be considered in the amount of tax revenue generated for governmental spending. If an industry is attempting to demonstrate the impact of direct jobs but adds the impact of indirect and induced jobs to the revenue stream, a mismatch of assumptions and results occurs. [Emphasis added.]

The NRA paper had given the gaming industry credit for tax revenues from gaming firms, non-gaming firms servicing the industry (indirect jobs) and from non-gaming firms where gaming employees shopped (induced jobs). Yet the paper ignored virtually all the increased governmental costs caused by the industry. Both sides of the "balance sheet" must be taken into account, wrote the CED analysts.

Significantly, the econometric simulation revealed a noteworthy difference in the need for state services when 8,000 new employees joined the hotel-gaming sector, as opposed to when the same number joined the manufacturing sector.

After the fourth year, the hotel sector "continues to generate population growth long after the manufacturing segment influence on population slows," reported the CED. That is "significant because of the increased burden in government services which population growth brings."

The number of jobs created by an industry, proportionate to any increase in population, provides a good indication of that industry's economic efficiency, say the CED authors.

"[T]he manufacturing sector produces more jobs but results in less population growth or migration. This indicates the manufacturing sector is much more efficient than the hotel sector" from the standpoint of the Nevada economy. The "true efficiency of the jobs compared to the government services required," argued the CED paper, "is significant in the most basic of cost/benefit ratios."

"Significant proof of job efficiency also occurs when the REMI model simulates the future wage rates of various sectors after the 8,000 employees are added into each of the study's sectors," the paper said. In banking, real estate, retail, finance, insurance and dining, "the manufacturing sector jobs will create a higher wage for these other sectors than the hotel industry would."

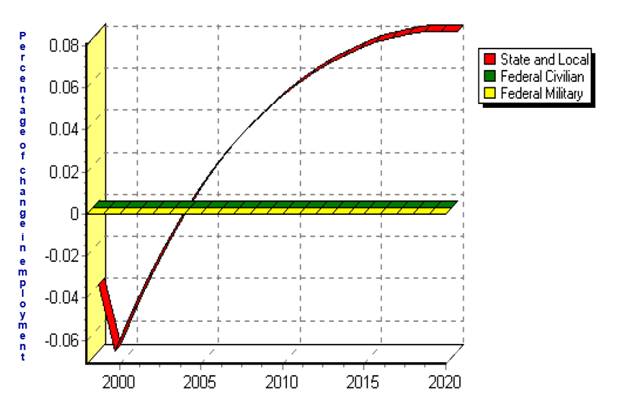

The REMI simulation also projected the number of additional government employees needed to provide services to the hotel sector vis-à-vis the number needed for services to the manufacturing sector.

The CED graph below reflects that difference. Initially the hotel segment begins with an immediate decline of about 28 employees and then, during the next 20 years, increases to over 120 more government employees than manufacturing would have caused.

While 120 more government employees may seem an insignificant increase, noted the CED paper, "if the actual numbers are applied to the 1998 wage rate study provided by [Department of Employment Training and Rehabilitation], the actual cash outlay of 120 government sector jobs would be $4.3 million, not including benefits or inflation. … This is increased revenue the government must have on an annual basis in order to maintain services to 8,000 hotel industry jobs compared to 8,000 manufacturing jobs."

"The gaming industry claims economic development and diversification is a hindrance rather than a help to the overall health of Nevada's system of taxation," concluded the CED analysis, asking: "But what should we reasonably expect from a system of taxation?"

Answering its own question, the CED said a good tax system would offer:

- Equity — Similar treatment for similarly situated taxpayers;

- Economic Efficiency — as little impact as possible on individual and business decisions;

- Broad Bases — so that tax burdens can remain low, minimizing taxation's effect on private-sector economic decisions; and

- Productivity — producing a predictable revenue stream that negates any need for frequent changes to bases and rates.

Concluding, the CED argued that "The gaming industry study failed to examine the job efficiency, broad base, and productivity aspects of the contributions of economic diversification to the taxation system.

"The simulations conducted by the Commission, on the other hand, show the manufacturing jobs brought to Nevada through the efforts of economic development groups promote job efficiency and do not cause the order of magnitude ‘strain on resources' claimed by gaming.

"In fact, the simulations show it is the population growth sustained by hotel industry jobs which conceivably cause a ‘strain on resources.'" [Emphasis added.]

Then the CED addressed gaming's counter-intuitive hostility to diversification, which, to the extent it is successful, could result in taxes on gaming ending up higher than otherwise would be the case.

"The diversification of the economy, furthermore, promotes a broad-based system of taxation in which reliance on gaming revenues is much less than it could be given the revenue needs of state and local governments.

"Finally, the creation of a strong manufacturing segment in the Nevada economy serves to mitigate the cyclical problems generated by relying too much on the fortunes of any one industry….

"Economic development promotes the diversification so desperately needed by many Nevada communities."

The state's other major players in the resistance to diversification of the Nevada economy will be the subject of Part V, the final part of this series, to be released next Wednesday, March 2, 2011.

Steven Miller is vice president for policy at the Nevada Policy Research Institute. For more visit http://npri.org.

Read more: