Greenspan and Bernanke’s war on Nevada

According to the most recent reports, Nevada leads the nation in the rate of homes that are in negative equity, at 55 percent. Nationally, the rate is about 20 percent. The primary reason for this disparity is that growth in Nevada—and in Las Vegas in particular—outpaced growth in the rest of the nation during the peak of the real estate bubble when land values were artificially high.

Consumers who purchased homes during that period did so at artificially high prices, courtesy of the Federal Reserve.

The Fed, as it's called, is the central planning agency for the American financial system. As central planners often do, the commissars of the American financial system have often made mistakes. Fed chairmen Alan Greenspan and then Ben Bernanke, despite their free-market rhetoric, have, in practice, adhered to the Keynesian philosophy articulated in the General Theory of Employment, Interest and Money. They actively used loose monetary policy to manipulate the national economy away from sound long-term policies in order to achieve the immediate goal of full employment.

Loose monetary policy injects new reserves of cash into the financial system, making credit artificially cheap and spurring investment. At the new lower interest rates, individuals are willing to buy more durable goods such as a house or a new car. Businesses are also willing to invest in new factories, machinery or real estate development.

The problem with this new investment is that it is made under faulty assumptions. The natural interest rate represents society's preferences for immediate versus delayed consumption. As the returns on investments rise, individuals are more willing to delay current consumption in exchange for a higher level of consumption at some future date. Artificially low interest rates disturb this balance by misrepresenting the amount of savings within society.

Injecting new dollars into the economy does not mean that new wealth is available. Paper money is simply a placeholder for wealth. Creating additional placeholders without creating new wealth simply means that each placeholder lays claim to a smaller share of the existing wealth. Yet, the lower interest rates create an illusion that more savings are available than is true—signaling individuals to invest in new development on the unfounded belief that there are enough savings available to bear out the investment.

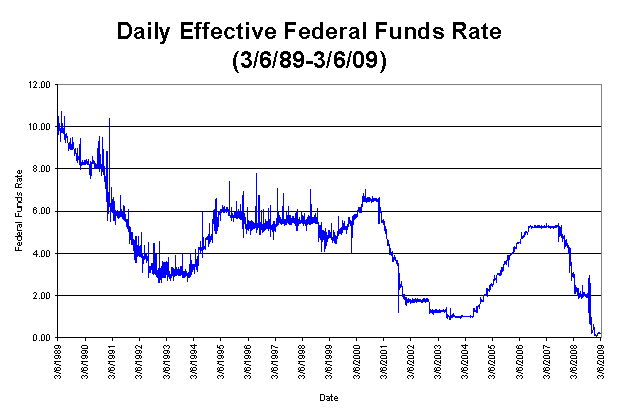

Financial central planners at the Fed regularly use monetary policy in this way to manipulate individuals into making bad investments. As can be seen in the following chart, Fed officials have increasingly injected new money into the financial system over the past 20 years in order to misrepresent the amount of available savings and spur unsound investment. Cuts to the Federal Funds Rate in the early 1990s led to large-scale speculative investment in the information technology industry. The resulting dot-com "bubble" market lasted until 2000, when investors began to realize that they had been duped.

In order to stave off economic downturn, however, Fed officials simply manipulated interest rates down even further—further misrepresenting the amount of savings available and spurring even more unsound investments. The Federal Funds Rate dipped below 1 percent in 2004. The result was that artificially cheap financing drove up the demand for housing and real estate—creating new bubble markets.

Beginning in late 2007, when market participants began to notice that they had again been duped, and that much less saving was available than the Fed had led them to believe, panic set in. Suddenly, it became apparent that the balance sheets of large financial institutions could not be reconciled. Over-leveraging had become pervasive, because of the Fed's carefully crafted illusion that more savings existed than was actually the case. Since then, the Fed has not been able to restore the old illusion—despite cutting interest rates to zero. (In a free, unmanipulated financial market, zero interest rates would imply that individuals are willing to sacrifice all future consumption for current consumption, which is obviously false.)

No state has been more ravaged by the Fed's reckless and destructive monetary policy than the Silver State. Nevada was the fastest growing state in the nation during the period of the most aggressive monetary expansion and the correspondingly high prices for housing and real estate. As a result, the new building that Nevada saw during this era occurred at artificially high prices.

As the market has adjusted to the Fed's earlier sabotage of naturally sound pricing, many families have discovered that their homes were actually overvalued when they purchased them—producing the situation where homeowners now have negative equity. These families are direct victims of the Fed's mischief. And the housing crisis in Nevada is a testament to the failures of central planning.

Government schemes to manipulate the economic decisions of individuals can no longer be tolerated. Supposed "solutions" offered by government to fix the problems that government has created only exacerbate the crisis. The housing crisis should lead all Nevadans to be ever vigilant regarding the schemes of elitist government officials. The time is now for an end to destructive government interventionism.

Geoffrey Lawrence is a fiscal policy analyst at the Nevada Policy Research Institute.