Solution of the week: How to reform Medicaid

Editor's note: Earlier this year, NPRI released Solutions 2013, a comprehensive sourcebook of research and recommendations in 39 policy areas. Now, each week during the run-up to the 2013 Legislative Session, NPRI will highlight one of these as its Solution of the Week. If you would like NPRI to speak to your organization about this or another policy recommendation, please contact Victor Joecks at vj@npri.org. Solutions 2013 is also available online here.

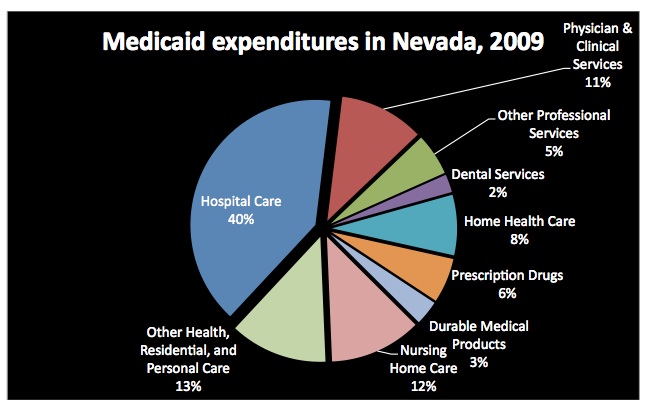

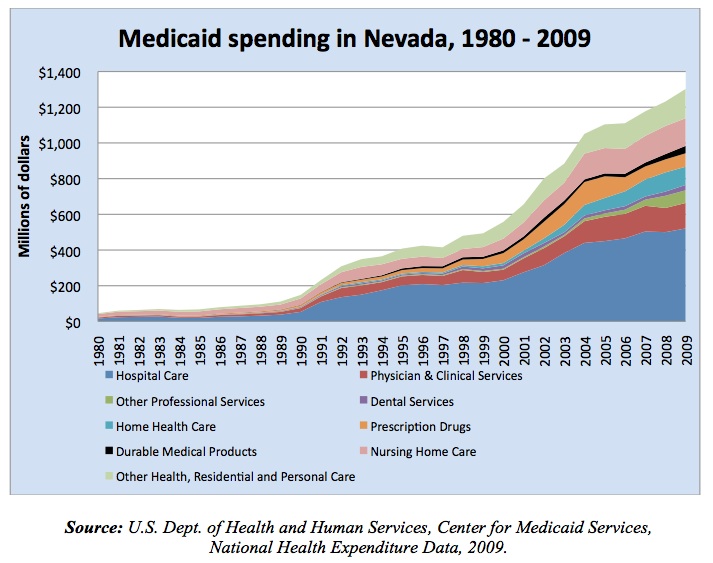

Even prior to passage of the unfunded federal mandate for increased Medicaid benefits in the Patient Protection and Affordable Care Act (PPACA), state costs for Medicaid were rising unsustainably. Even without PPACA, Nevada's Medicaid costs were projected to grow faster than the most optimistic assumptions of the state's gross domestic product.

Currently, with PPACA mandates in place, the number of Medicaid enrollees in Nevada is projected to increase from 268,000 in 2009 to about 802,000 by 2023. The cost increases entailed by such enrollment growth make it essential that lawmakers reform Nevada Medicaid, if only to maintain the program's affordability.

Key Points

Access to insurance and access to care are not always synonymous. While Medicaid was intended to ensure access to health care for highly vulnerable populations, policymakers' traditional approach to controlling Medicaid costs — reducing reimbursement rates for health‐care providers — works against this end. Given the very real prospect of being short‐changed, many providers elect not to accept new Medicaid patients at all. Recent surveys indicate that only 40 percent of physicians accept all new Medicaid patients.

As currently structured, Medicaid benefits may not be beneficial. Researchers at the University of Virginia have found, when it comes to health outcomes, it is better to be uninsured than on Medicaid. After examining a broad survey of surgical outcomes and adjusting for age and risk factors, their 2010 analysis finds that "surgical patients on Medicaid are 13% more likely to die than those with no insurance at all, and 97% more likely to die than those with private insurance."

Cost inflation results from a lack of price sensitivity. Health‐care costs in the United States have skyrocketed in recent decades, as third‐party payers finance more and more health‐care costs. When individuals do not directly bear a significant share of treatment costs, they are more likely to approve unnecessary treatments. Those additional costs are then borne collectively — requiring higher premiums all around.

Price competition controls cost growth. The American health‐care industry is suffering under a government-induced price‐system failure. Consumers have become insensitive to the prices of procedures and, as a result, do not shop among providers for the best value. This lack of consumer attentiveness allows providers to raise prices without restraint. In short, price signals in the health‐care industry no longer convey the information necessary for individuals to effectively coordinate their resources and desires.

Recommendations

Restructure Medicaid benefits around a "Health Opportunity Account (HOA)." The federal Deficit Reduction Act of 2005 allowed states, for the first time, to incorporate the benefits of private‐sector health savings accounts into the way Medicaid benefits are delivered. States can now submit a state plan amendment to the Center for Medicaid Services to establish HOAs.

States that elect to establish HOAs deposit Medicaid dollars into a beneficiary's private account. The beneficiary can then use those dollars to purchase medical services directly. If the beneficiary uses Medicaid providers, the account is debited at standard Medicaid rates. For non‐participating providers, the account is debited at a higher rate. When a beneficiary's income rises and Medicaid eligibility ends, 25 percent of the balance remaining in the account returns to the state. The remainder is available to the beneficiary for the purchase of health coverage, job training or college tuition.

HOAs cut through the bureaucracy and allow beneficiaries to purchase coverage directly. They also make beneficiaries price sensitive for health services, leading to more judicious behavior and better cost control.

Geoffrey Lawrence is deputy policy director at the Nevada Policy Research Institute. For more visit http://npri.org.

Read more: