State correctional officer more than triples $57,000 salary to over $200,000 with OT, benefits

Today the Nevada Policy Research Institute released 2017 salary data for over 115,000 state and local government workers on TransparentNevada.com — the state’s largest public pay database.

The data reveals massive levels of overtime pay (OT) for state employees, particularly correctional officers, who dominate the top of the OT list among state workers.

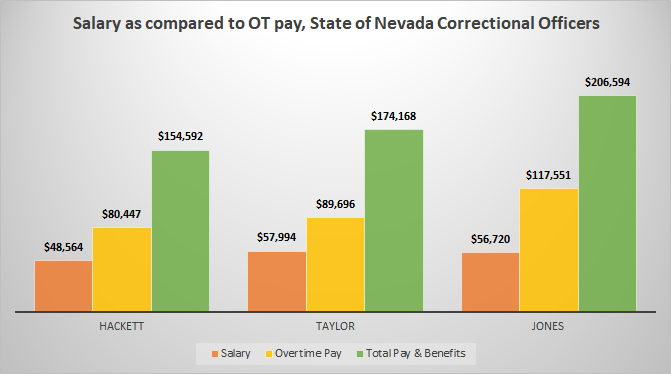

Topping that list is correctional officer Jimmy Jones, who received an additional $117,551 in OT pay on top of a $56,720 salary. With benefits, Jones collected a total of $206,594 in compensation last year.

The next highest OT payment for state workers went to Division of Child and Family Services Group Supervisor Michael Taylor, who received $89,696 in OT pay, on top a $57,994 regular salary.

Following Taylor, the next 7 highest OT payments all went to correctional officers, all of which received OT pay that more than doubled their regular salary.

When measured as a percentage of base salary, no state worker received more in OT pay than correctional officer Stewart Boyer, whose $74,560 OT payout dwarfed his $33,496 base salary, helping bring his total compensation to $135,444 — or more than 4 times his base salary.

In total, 19 state correctional officers received OT pay that exceeded their base salary, while 135 received OT pay that was at least 50 percent of their regular salary.

These figures confirm the suspicions of Nevada Department of Corrections deputy director of support services John Borrowman, who reportedly said that “it would be naïve to think the system is not being gamed.”

A recent report by Governor Brian Sandoval’s Executive Branch Audit Committee confirms the system is actually rigged by design, according to NPRI Executive Director of Transparency Robert Fellner.

“Before the Governor championed raising wages and hiring more correctional officers — further burdening taxpayers with higher government spending — the very least he should have done was address the fundamentally abusive and wasteful practice of paying overtime to those who aren’t even working a full shift.

“According to his department’s audit, this inherently abusive practice has resulted in instances of officers being paid for 20 hours of “work” despite only working a regular 8-hour shift. In fact, the audit found that 20 percent of overtime pay — or $2.8 million — went to officers who did not even work a regular 40-hour week.

“This example shows, yet again, why so many Nevadans are fed up with politicians who believe every solution to a so-called ‘budget shortfall’ is to increase taxes and raise spending, rather than addressing the glaring waste laid bare before them.”

Visit TransparentNevada.com to access the entire payroll dataset in a searchable and downloadable format. The 2017 data for many of Nevada’s local governments is also available on the site, with the few yet-to-be posted agencies expected to be made available in the coming weeks.

TransparentNevada.com is a project of the Nevada Policy Research Institute. To learn more about NPRI’s efforts to increase government transparency, please click here.

###

TransparentNevada.com is a project of the Nevada Policy Research Institute. Nevada Policy fights to make sure Nevadans keep more of their hard-earned money by exposing wasteful government spending and promoting low-tax solutions to Nevada’s economic challenges. The Institute also supports a transparent and open government.