Union boss relies on falsehoods to make case for collective bargaining

In an opinion column for the Las Vegas Review-Journal, Nevada State Employees Union President Harry Schiffman argues that collective bargaining should be extended to state government workers.

Because he stands to profit both personally and professionally from his proposal, it is unsurprising that Schiffman would be willing to play a bit fast and loose with the facts in an effort to make the most compelling — albeit disingenuous — argument possible.

Unfortunately, Schiffman doesn’t stop there. In trying to sell the Legislature on extending collective bargaining to state government workers — a concept that was historically opposed even by prominent union leaders and other champions of the organized labor movement — Schiffman relies almost exclusively on falsehoods and misconceptions.

Here are just a few of the false, misleading and downright-insulting claims made in Schiffman’s proposal as the basis for extending collective bargaining to state government workers:

Demonstrably false claim number 1: “We have just witnessed a 30-year period during which the tax burden — nationally and here at home — has been shifted onto the backs of working men and woman who can afford it least.”

In reality, the exact opposite is true.

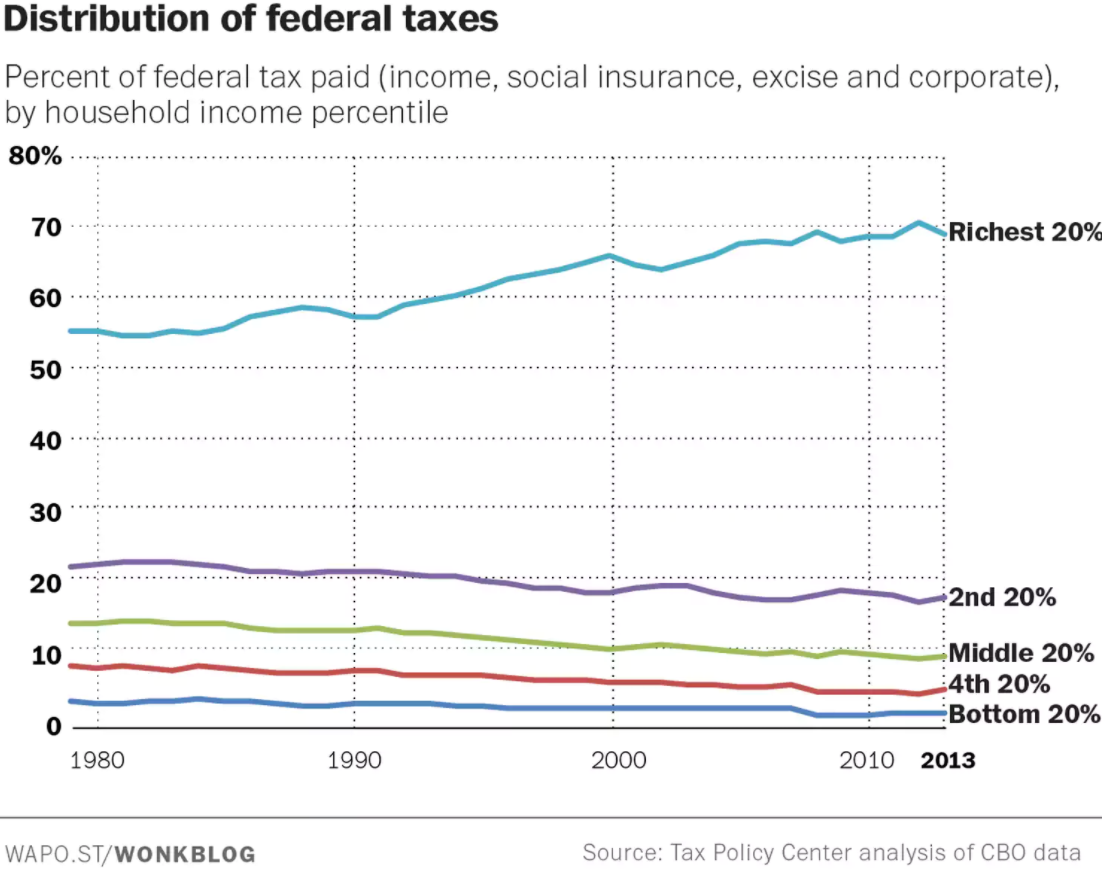

Over the past 30 years, the federal tax burden has become significantly more progressive, with the 70 percent of all federal taxes paid by the top 20 percent of earners in 2013 representing a substantial increase from the 55 percent they paid 30 years prior.

In other words, the wealthy are paying more taxes than ever before.

Furthermore, that substantial increase occurred alongside a steady decline in the tax burden faced by all other income brackets, as show in the Washington Post chart below:

Likewise, lower income brackets have also fared the best when measuring the change in effective tax rates. That same Washington Post analysis found that while everyone has seen a reduction in their effective tax rates as compared to the 1970s and 1980s, generally speaking, “the lower income brackets have seen the steepest percentage-point declines.”

As the above data makes clear, Schiffman’s claim that the national tax burden has been shifted toward “those who can afford it least” is a complete fabrication.

Within the state of Nevada — which has no income tax — the picture is admittedly more mixed. In an effort to fund the perpetual growth of state and local government spending, Nevadans have seen a slew of new business and sales tax hikes in recent years.

It is true that some of these taxes, particularly sales taxes, are indeed regressive — disproportionately harming lower income families and individuals.

But this actually hurts Schiffman’s broader point, as the alleged need for these regressive tax hikes are the result of the undue influence of Nevada’s local unions, and the increased tax burden they create.

Washoe County’s recent sales tax hike, for example, was passed to fund school construction — costs that are inflated, on average, by 45 percent thanks to the state’s so-called prevailing wage law.

Unsurprisingly, the unionized construction companies who receive this windfall use some of those profits to keep the gravy train rolling — rewarding compliant politicians while punishing those who would seek to create a level playing field. And there is quite a bit of gravy to fight over: In just 2009 and 2010 alone, the excess costs from prevailing wage totaled nearly $1 billion.

Similarly, the recent hike to Clark County’s sales tax was sold as being needed to put more Las Vegas Metro cops on the streets. This alleged need, however, was directly tied to local government unions having successfully inflated the average officer’s compensation far above market levels.

The average wage for a Metro police officer is higher than what 90 percent of their peers nationwide earn, a cost exacerbated by gold-plated retirement plans that cost more than 10 times the median private-sector employer retirement contribution — all of which is funded by regressive taxes on local residents.

In other words, it is the growth of local government — fueled by the unionization of local government employees — that is responsible for making Nevada’s tax burden more regressive.

Thus, Schiffman’s proposal to extend collective bargaining to state workers would only exacerbate this regressive tax-and-spend trend in Nevada.

Falsehood number 2: “…many [state workers] earn less than a livable salary because they are legally prohibited from negotiating with their employer.”

What state government workers earn less than “a livable salary?” And given the median full-time, year-round Nevada state government worker earned $53,330 in 2016, according to the U.S. Census Bureau, how would Schiff describe the $41,640 median earnings received by Nevada’s private-sector workers?

In related news, a robust academic study that controlled for similar levels of education, skills and job responsibilities found that the average Nevada state government worker earned 20 percent more in total compensation than their private-sector counterpart, a disparity which rose to 29 percent when the value of job security is included.

State government wages appear to be pretty livable.

Falsehood number 3: “Collective bargaining is the vehicle that ensures working people have access to the American Dream — except for state workers, the men and women who keep Nevada running.”

The claim that state workers are the ones “who keep Nevada running” likely won’t sit well with the remaining 95 percent of Nevada workers who pay the taxes necessary to keep government running.

The first half of the statement, however, is completely false.

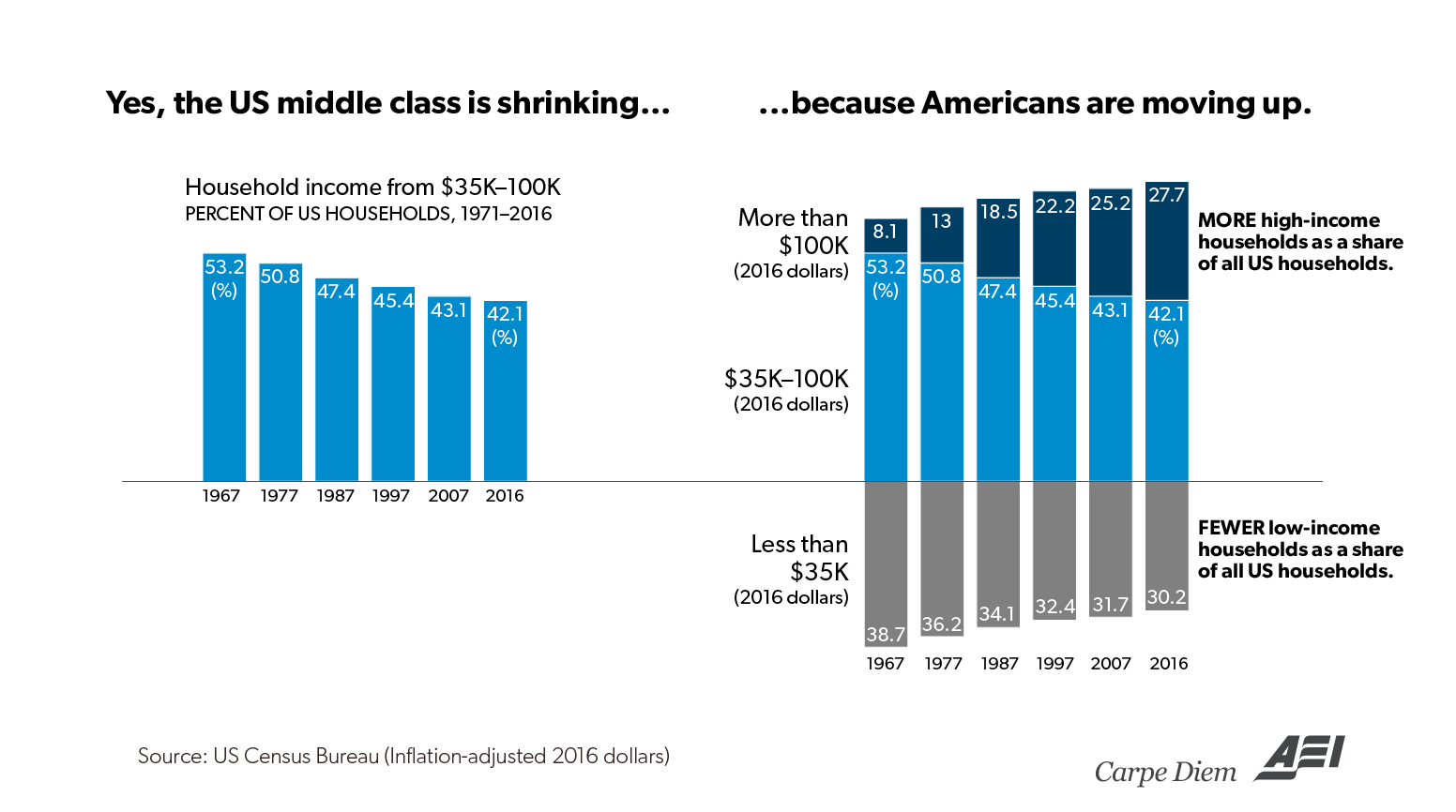

As unionization in the private-sector has dropped to all-time lows, the number of Americans realizing the American Dream has actually soared:

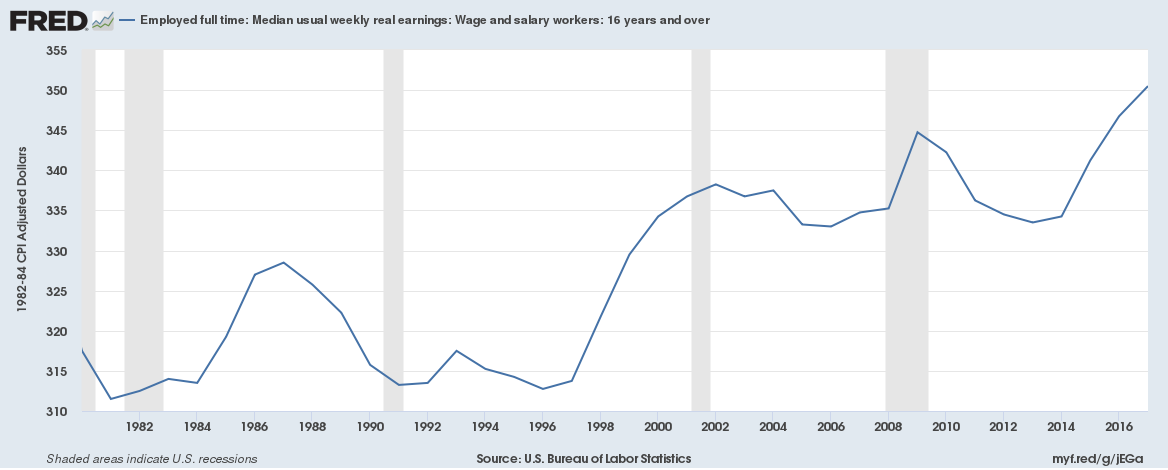

Likewise, median real earnings for full-time workers have risen to all-time highs as well:

But looking only at earnings greatly understates the growth in income, as today’s workers receive a vastly larger share of their compensation in non-wage benefits like health insurance and retirement benefits.

When those benefits are accounted for, average real compensation has increased by 45 percent since 1964, according to Troy University Assistant Professor of Economics Daniel J. Smith.

If collective bargaining was what made Americans prosper, we would expect to see a decline in earnings as unionization plummeted from over 30 percent of private sector workers in 1965 to only 6.5 percent today.

Instead, the exact opposite has happened.

Wages and total compensation are higher and, most importantly, the percentage of high-income American households has soared while the percentage of low-income households has declined.

Insulting claim: “Collective bargaining is the only way for people who work to have a real say in their futures and to achieve some dignity at their workplace.”

It’s hard to imagine that the 93.5 percent of private-sector workers who are not unionized share Schiffman’s view that they have no say in their future. After all, these workers negotiate on their own behalf every time they push for a raise, a promotion or a new job.

And as the data above indicate, these workers have done quite well without a one-size-fits-all collective bargaining agreement governing their workplace.

Claim with which we (almost) agree: “It is time for that legislative inequity [allowing collective bargaining for local government workers but not state workers] to be addressed.”

Schiffman was bound to get something somewhat right.

However, if one truly cares about the working middle-class at large, the way to address this inequity is to repeal mandatory collective bargaining for local government workers — not extend it to all sectors of government.

Because the government has no profits over which to negotiate, there is no basis for collective bargaining among its employees. Instead, imposing collective bargaining into the public sector creates a dynamic wherein elected officials and union leaders both profit from an increased tax burden.

This is why so many of the labor movement’s biggest champions opposed collective bargaining:

All Government employees should realize that the process of collective bargaining, as usually understood, cannot be transplanted into the public service. It has its distinct and insurmountable limitations when applied to public personnel management. The very nature and purposes of Government make it impossible for administrative officials to represent fully or to bind the employer in mutual discussions with Government employee organizations – President Franklin D. Roosevelt.

And that is why current advocates for extending collective bargaining to government workers must rely so heavily on falsehoods and misdirection when making their case. An honest accounting of the facts, however, reveals that such a scheme would harm the vast majority of hardworking Nevadans.