Prevailing Wage Rates, 2019

Nevada law requires governments to pay wildly inflated labor costs on public works projects, which are known as “prevailing wage” rates. This practice takes tens of millions of dollars out of the classroom each year, according to the fiscal notes submitted by Nevada school districts.

When NPRI first analyzed the cost of these so-called prevailing wage rates, we found that they cost taxpayers an additional $1 billion in 2009 and 2010. At that time, the prevailing wage rate was, on average, 45% higher than the actual market rate.

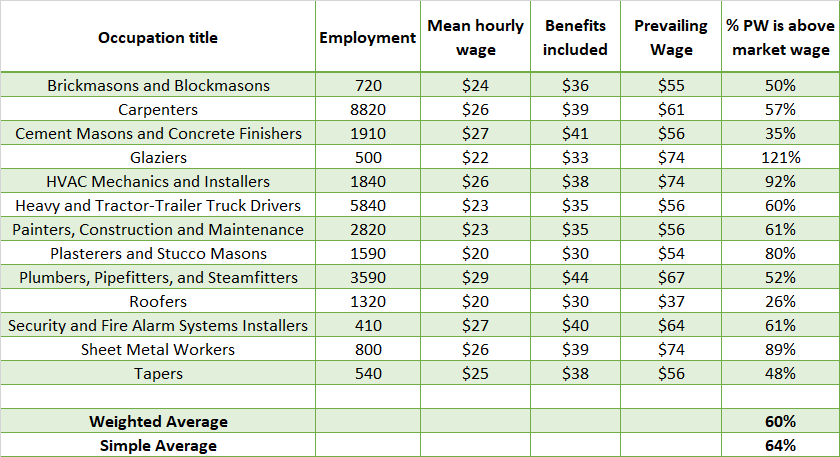

The below chart compares the 2019 prevailing wage rates for 13 job categories in Clark County, which represented over half of all construction employment that year, against the average wage earned for all workers in that same profession.

Because the prevailing wage rate also includes the cost of benefits, we increased the average market wage by 50 percent to account for the cost of benefits in the private sector. This is an extremely conservative assumption, meaning that the actual disparity is likely even greater than what is reported here.

The Clark County prevailing wage ranged from 26% above the market wage for roofers, to a staggering 121% above the market wage for glaziers, with the average prevailing wage rate coming in at 64% above the market wage:

Table 1: Average wage and prevailing wage in Clark County, Nevada (2019)

Prevailing wage laws are a classic example of a concept known as concentrated benefits and dispersed costs.

While these laws clearly harm taxpayers, students and the general public, the cost to each is relatively dispersed. Furthermore, it can be difficult for the general public to recognize how laws like these lead to higher taxes.

The politically-connected unions who benefit, however, reap a windfall worth tens of millions of dollars each year, part of which they can then use on aggressive lobbying efforts designed to keep the prevailing wage law in place.

This explains why Democrat lawmakers support Nevada’s prevailing wage laws, despite their constantly bemoaning an alleged shortfall of money for public schools — the support of the union is more politically valuable than what they stand to gain from doing what is right.

Further Reading: