A blueprint for Nevada’s financial path forward

The most current fiscal projections indicate Nevada’s Fiscal Year 2021 revenues may be upwards of $1 billion shy of what the legislatively-approved budget requires.

The following policies, if implemented swiftly, will naturally decrease the impending budget gap for Fiscal Year 2021 and years thereafter.

In conjunction with unavoidable—and necessarily dramatic—cuts to the FY2021 budget, the following policies should be vigorously pursued to allow Nevada taxpayers, businesses, and individual workers to flourish in the wake of the COVID-19 economic crisis.

Click on the below topics to jump to that section:

- Statewide freeze on hiring of government employees and pay raises

- Transparency in government-sector collective bargaining

- Charter agencies reform

- Performance auditing

- Eliminating prevailing-wage mandates for public works projects

- Expansion of educational-choice programs

- Strengthening the Nevada Public Records Act

- Medicaid work requirements

-

Statewide freeze on hiring of government employees and pay raises

The proposal to implement a hiring and pay freeze on all state government employees is self explanatory, and has apparently already been embraced to some extent by Governor Sisolak. Nevada cannot afford additional public-personnel costs at this time while hoping to narrow the budget deficit. In fact, the state should be proactive in identifying other available means of reducing the costs associated with its operating workforce wherever possible and appropriate. Layoffs, furloughs, and other such options of reducing public compensation costs should be considered.

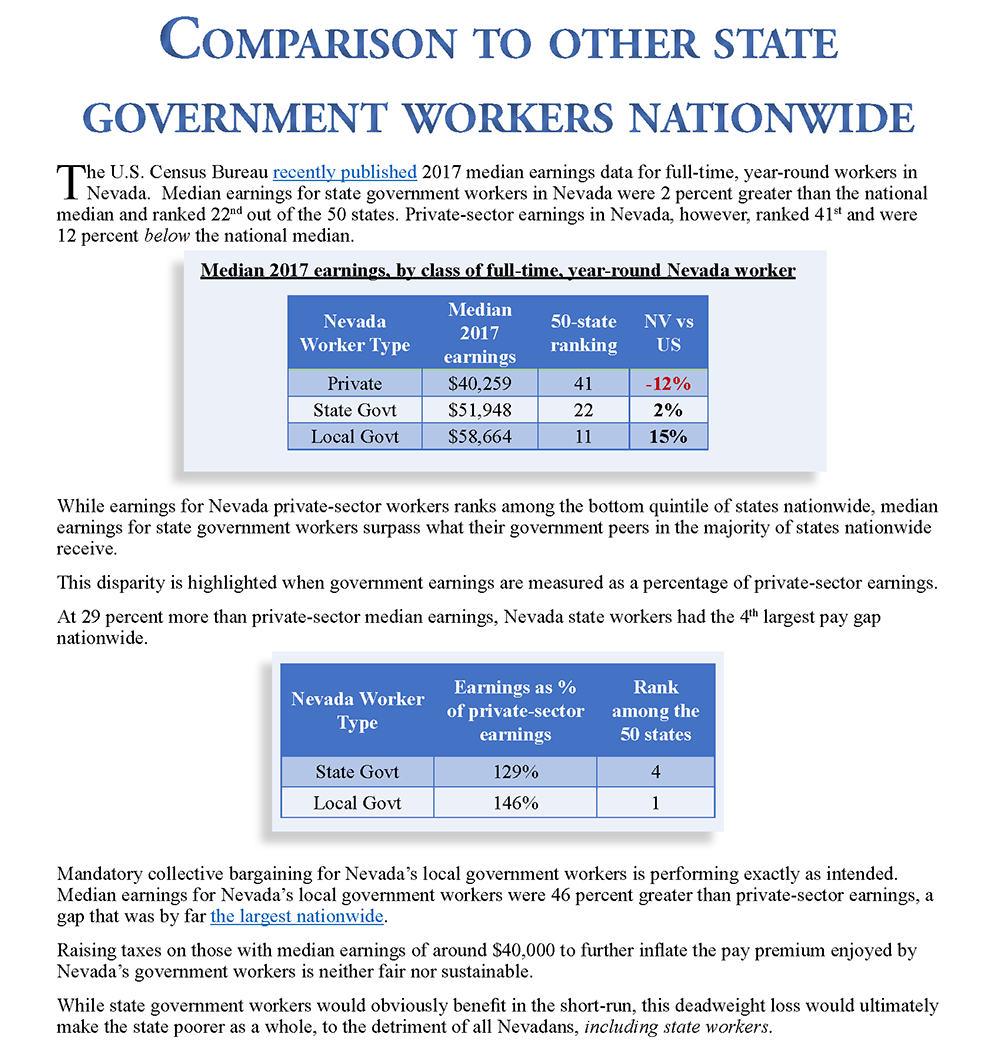

The private-sector workforce should not be expected to assume the totality of economic costs due to COVID-19. Likewise, the government workforce will have to share in bearing some of these costs if Nevada is expected to recover to a pre-coronavirus boom for the economy. The typical Nevada government employee, after all, earns far more in wages and benefits than his private-sector counterpart:

>>>Click here to return to the top of the page<<<

-

Transparency in government-sector collective bargaining

Myriad collective-bargaining agreements are set to expire this summer, meaning new ones will soon have to be negotiated. Moreover, last year the 2019 Nevada Legislature authorized collective-bargaining rights for the state’s 20,000+ state-level workers via Senate Bill 135. Negotiations involving newly-certified state-level unions will soon commence, surely increasing long-term compensation costs to the state by hundreds of millions and threatening budget solvency in the future. (Click here for more background.)

Employee compensation and benefits are among the largest capital expenditures in any state or local-government budget. Given what is projected to happen with plummeting tax revenues, it is more important than ever that these bargaining sessions take place in public view so citizens and public workers alike are able to hold their government officials accountable for the labor deals they strike. State- and local-government simply cannot afford collective bargaining agreements which will necessitate higher tax burdens in future years to be negotiated and agreed upon behind closed doors.

Yet state laws — NRS 288.220 and NRS 288.590 — specifically exempt these bargaining sessions from the requirements of Nevada’s Open Meetings Law (NRS 241) and, implicitly, the Public Records Act (NRS 239), meaning regular citizens — and even public workers themselves — do not have the right to witness union negotiations as they occur. There is, however, no justification for negotiating these contracts in secret: These are taxpayer dollars at stake and, as such, the public should be permitted to monitor these negotiations in real-time — especially during the kind of economic downturn Nevada is currently experiencing. How else can taxpayers hold their elected officials accountable for any unaffordable deals they might strike with organized labor?

Yet state laws — NRS 288.220 and NRS 288.590 — specifically exempt these bargaining sessions from the requirements of Nevada’s Open Meetings Law (NRS 241) and, implicitly, the Public Records Act (NRS 239), meaning regular citizens — and even public workers themselves — do not have the right to witness union negotiations as they occur. There is, however, no justification for negotiating these contracts in secret: These are taxpayer dollars at stake and, as such, the public should be permitted to monitor these negotiations in real-time — especially during the kind of economic downturn Nevada is currently experiencing. How else can taxpayers hold their elected officials accountable for any unaffordable deals they might strike with organized labor?

Fortunately, there is broad public support for this reform. According to February 2020 polling, 73 percent of likely Nevada voters — including two-thirds of current union members — support bringing sunlight to government-union negotiations. (Read more here.)

Further, Governor Sisolak is a long-time proponent of increased transparency in government-union negotiations. While a member of the Clark County Commission, he once declared the following:

“The public that is ultimately paying this bill has a right to know what’s being negotiated away or not… I think that everybody should be in favor of transparency.”

This indicates Governor Sisolak may be inclined to approve legislation to bring sunlight to union negotiations if lawmakers deliver to his desk such a bill.

>>>Click here to return to the top of the page<<<

-

Charter agencies reform

Nevada’s state government, like most other states, has over time turned into a collection of rigid bureaucracies conditioned to emphasize strict adherence to legislatively prescribed processes, rather than focus on achieving quantifiable results.

Lawmakers should recognize that it’s often the employees of state agencies who bring the greatest knowledge and insight into how those agencies can most effectively deliver public services. The top-down approach to governance that lawmakers have historically imposed fails to take advantage of the state’s most valuable asset — the specialized knowledge of its employees.

The task of lawmakers should be restricted to setting broad policy goals, while specific decisions over the means for achieving those goals should be left to the agencies themselves.

The task of lawmakers should be restricted to setting broad policy goals, while specific decisions over the means for achieving those goals should be left to the agencies themselves.

Nevada should thus prioritize legislation meant to empower individual agency directors. This reform was recently implemented in Iowa, where lawmakers looking to increase the cost-effectiveness of government successfully experimented, highlighting broad policy objectives while letting agency directors determine the best means of achieving those objectives.

To ensure accountability, annual contracts can be signed with Nevada agency directors, specifying the performance metrics they would be responsible for meeting at the risk of dismissal.

Directors might further agree to reduce General Fund allocations, but in exchange, gain the freedom to hire and fire employees, upgrade their agencies’ technology infrastructure, purchase equipment and outsource certain agency functions as they see fit — without going through the state’s central purchasing or personnel departments.

Nevada should create a “charter agency” framework and allow agency directors to opt in. Agency directors who opt in should sign performance contracts that outline their responsibilities for meeting legislatively-defined goals. These contracts should reward each agency increase in excellence with increasing agency discretion.

Over time, the charter-agencies framework would reduce operating costs and make government more efficient for those it serves.

>>>Click here to return to the top of the page<<<

-

Performance auditing

Entrepreneurs in the private sector often hire consultants to advise them on how best to streamline operations and deliver goods to market as efficiently as possible.

Public‐sector entrepreneurs who direct charter agencies could benefit from similar advice. The State of Nevada can ensure such valuable support for its new charter agency directors by empowering the state controller with a broad mandate and sufficient funding to conduct performance audits at state and local levels.

Auditors should always remain free of political influence. Currently, the only state auditing offices in Nevada serve at the pleasure of incumbent politicians: The Audit Division of the Legislative Counsel Bureau is directly subordinate to legislative leadership while the Department of Administration’s Division of Internal Audits is ultimately subordinate to the governor.

This subordinance compromises auditors’ ability to choose which government agencies or functions should be reviewed as well as the integrity of their findings — which become subject to potential suppression by interested politicians. For this reason, state audit functions should be consolidated into a single office with independent electoral accountability.

Performance audits are different than financial audits. Financial audits merely review and reconcile accounting statements and practices without evaluating the relative effectiveness of each spending item. Performance audits go a step further by identifying the organizational structures and spending practices that would achieve optimal results.

Performance audits are different than financial audits. Financial audits merely review and reconcile accounting statements and practices without evaluating the relative effectiveness of each spending item. Performance audits go a step further by identifying the organizational structures and spending practices that would achieve optimal results.

Performance audits are a natural complement to charter agencies. While a performance audit can be valuable to any organization, the organizational structure of charter agencies especially aligns the incentives facing agency directors with those of lawmakers and taxpayers. When agency directors and their employees see a direct financial benefit — and not a loss — as the result of increased cost‐effectiveness, they have every motivation to actively solicit and aggressively implement the recommendations of performance auditors.

The State of Nevada should thus extend a mandate and sufficient funding to the state controller to conduct performance audits. Existing auditors’ offices in the legislative and executive branches could be consolidated with the controller’s office and used to conduct performance as well as financial audits. The controller should gain explicit authority to conduct performance audits for any state or local government. Local government expenditure in Nevada has historically been a more significant component of public spending than state expenditure. Therefore, while performance audits of state agencies are valuable, the financial impact could be far greater if the controller also examines local government operations.

>>>Click here to return to the top of the page<<<

-

Eliminating prevailing-wage mandates for public works projects

Since 1937, Nevada law has required that workers building state-funded public works projects receive a special kind of minimum wage, called “prevailing wage.”

Prevailing wage laws might sound like they are intended to ensure that workers receive wages reflective of the local labor market, but these laws are administered in a way that ensures construction unions are able to control these state-mandated wage rates.

The bias in favor of trade unions leads to wage rates far above those found on the local labor market. This inflates the labor-cost component of public works projects — straining taxpayer resources and ultimately limiting the number of projects that can be completed.

To get a sense of just how inflated these mandated rates are, NPRI analyzed the 2017 prevailing wage rates for 14 job categories in Clark County, which accounted for more than half of all construction employment that year.

The prevailing wage ranged from 14 percent above the market wage for roofers, to a staggering 109 percent above the market wage for glaziers. On a weighted basis, the average Clark County prevailing wage was 56 percent greater than the market wage:

(Click here for more information)

Recent (2015) albeit modest prevailing-wage reforms were reversed by the 2019 Legislature, needlessly increasing the taxpayer burden of such projects such as school construction by tens of millions. Such prevailing-wage mandates should be discarded in favor of restoring balance to Nevada’s budget going forward.

>>>Click here to return to the top of the page<<<

-

Expansion of educational-choice programs

Apart from the myriad positive effects for students who participate in choice programs (e.g., the Nevada Educational Choice Scholarship Program, or “Opportunity Scholarships”), school choice benefits taxpayers too!

Contrary to the claims made by those who oppose introducing choice and competition into the educational system, school choice programs actually increase per-pupil funding for students who remain in public schools!

Understanding this cost-saving dynamic is simple: Between state and local revenues, taxpayers spend more than $10,000 per pupil, per year, educating students in the government-monopoly system. Yet the scholarships awarded through programs like Opportunity Scholarships are valued at several thousand dollars less on an annualized basis. Thus, for every student who utilizes a scholarship to attend a private school of his or her own choosing, the state saves thousands in costs.

These savings can then be reinvested in the traditional K-12 system to increase per-pupil funding — the only metric which seems to matter to defenders of the public school system — specifically targeting underserved student populations (e.g., English learners) who are most in need of additional education funding.

A 2018 Nevada Policy report found that expanding the Opportunity Scholarship program to allow for 25,000 participating students could have the effect of increasing K-12 per-pupil funding by approximately $235 — mimicking the effects of an additional $116 million in annual education funding.

>>>Click here to return to the top of the page<<<

-

Strengthening the Nevada Public Records Act

Since it was first enacted in 1911, the Nevada Public Records Act (NRS 239) has been a crucial public-policy tool allowing regular citizens and influential stakeholders to hold their government accountable.

The NPRA’s explicit purpose, as written into the Nevada Revised Statutes, is “to foster democratic principles by providing members of the public with access to inspect and copy public books and records to the extent permitted by law.” Notably, the NPRA requires that its provisions “be construed liberally to carry out this important purpose.”

When governments adhere to the requirements of the law, the NPRA works well. It allows watchdog organizations like Nevada Policy to keep an eye on the activities of the governing class. For example, each piece of data Nevada Policy publishes on TransparentNevada.com, Nevada’s largest public-sector pay database, was acquired via requests for public records, pursuant to the NPRA.

When governments adhere to the requirements of the law, the NPRA works well. It allows watchdog organizations like Nevada Policy to keep an eye on the activities of the governing class. For example, each piece of data Nevada Policy publishes on TransparentNevada.com, Nevada’s largest public-sector pay database, was acquired via requests for public records, pursuant to the NPRA.

Unfortunately, government agencies across Nevada — both state and local — have learned over the years they can flagrantly disregard the law’s requirements with impunity because they are, quite literally, never disciplined for doing so.

Governments’ flouting of the law manifests in different ways. Some will deny a valid request for government documents on the false basis those documents are confidential under state law. Others may be willing to provide the requested documents, but only if the requester agrees to pay a hefty and often disproportionate fee. Others still will simply ignore a citizen’s request for public records altogether.

These unlawful yet typical actions by government constitute a weakening of the public’s ability to hold their elected officials accountable and can no longer be tolerated, especially in the Coronavirus-budget-deficit context.

Modest reform was accomplished during the 2019 legislative session when the governor signed Senate Bill 287, which implemented statutory, escalating penalties against those government agencies shown to have willfully disregarded the spirit and text of the NPRA. However, proposed penalties against the specific individual responsible for denying a valid request for public records were removed from the original draft legislation due to massive political pressure applied by state and local-government lobbyists.

Legislating statutory penalties against individual government officials is needed to ensure that government complies with the requirements of the NPRA. A transparent and accountable government is paramount to Nevada’s COVID-19 economic recovery.

Learn more about the need for increased penalties against individual violators of the NPRA by clicking here.

>>>Click here to return to the top of the page<<<

-

Medicaid work requirements

Medicaid was originally meant to serve as a safety net for the nation’s most indigent — meaning children of low-income households, the elderly and the disabled. However, thanks to ACA-directed Medicaid expansion, the program now caters to more than 600,000 Nevadans at an annual per-recipient cost of about $5,700. Such costs are unsustainable over the long run without dramatic tax increases.

To curb costs and restore accountability to the state’s Medicaid program, Nevada can apply to the federal government for a Medicaid 1115A waiver for the purpose of implementing work requirements for all able-bodied Medicaid enrollees.

The need for imposing fiscal restraint and accountability is made clear by the fact that upwards of 60 percent of Medicaid expansion enrollees did not work at all during 2015, according to the Foundation for Government Accountability.

The Trump Administration recently signaled its willingness to approve such applications on an expedited basis, and Nevada’s leaders shouldn’t delay.

That said, Medicaid waivers are only one of many health care-related administrative actions which state officials can consider to incentivize higher levels of employment, thus reducing the growing strain on Nevada’s state budget. Policymakers would be wise to review all possible state-based avenues of reform given the impending Fiscal Year 2021 budget deficit.

>>Click here to return to the top of the page<<<