2021 Legislative Review and Report Card

A downloadable PDF version of this report is available by clicking here.

*Click here to learn how rankings are determined.

Keep scrolling to read the report in its entirety or download a PDF of this report.

If 2020 offered the nation an example of how not to govern, the 2021 Nevada Legislature offered our state’s taxpaying populace a lesson in how not to legislate.

If 2020 offered the nation an example of how not to govern, the 2021 Nevada Legislature offered our state’s taxpaying populace a lesson in how not to legislate.

Though Governor Sisolak invoked his emergency authority (pursuant to Chapter 414 of the Nevada Revised Statutes) in March 2020, many of his over-arching and constitutionally-suspect restrictions were still in place some 10+ months later, when the 2021 Nevada Legislature convened on February 1, 2021.

What this meant was, only lawmakers, their staffers, certain journalists, and Legislative Counsel Bureau personnel were permitted to enter Nevada’s Legislative Building—our state’s ostensible “House of the People.” All other interested parties, including professional lobbyists and citizen-activists alike, would not be permitted any entry into the legislative building until mid-April, well beyond the midpoint of the biennial 120-day session. Even then, when restrictions were partially lifted, the Legislature allowed only for very limited, public access, requiring 24 hours’ advance notice, plus proof of COVID vaccination, or an on-site “negative” COVID test for entry into the building. Such was the intolerable status quo until the session’s final days, when restrictions were again eased to allow for slightly more public engagement as vaccination rates rose.

Whereas an accountable and representative government is only made possible through stringent adherence to its transparency laws and policies, neither the dual-chamber Democrat majority nor Governor Sisolak saw any urgency in opening the building to the public—notwithstanding the fact that restaurants, businesses, etc. had already been operating for months with less onerous restrictions than those mandated by the Nevada Legislature.

Before diving deep into what transpired during Nevada’s 81st legislative session—the good, the bad, and the ugly—it’s worth mentioning that Governor Sisolak’s supposed “emergency powers” continue to pervert our three-branch governmental system of checks and balances. The governor’s one-man rule has been in effect for a year and a half, and he’s expressed little indication of relinquishing his control—no doubt the characteristics of an aspiring tyrant.

More concerning, however, is that Governor Sisolak, from day one of the COVID “emergency,” has overstepped the bounds set for him in both the Nevada Revised Statutes and the Nevada State Constitution.

>>>Return to Table of Contents

In February 2021, Nevada Policy made headlines by publishing a report detailing the myriad ways in which Governor Sisolak had, to that point, abused the emergency powers supposedly granted to him by NRS 414.

The relevant provisions of NRS 414 declare, in part:

Because of the existing and increasing possibility of the occurrence of emergencies or disasters of unprecedented size and destructiveness resulting from enemy attack, sabotage or other hostile action, from a fire, flood, earthquake, storm or other natural causes, or from technological or man-made catastrophes, and in order to ensure that the preparations of this state will be adequate to deal with such emergencies or disasters, and generally to provide for the common defense and to protect the public welfare, and to preserve the lives and property of the people of the State, it is hereby found and declared to be necessary:

(a) To create a state agency for emergency management and to authorize the creation of local organizations for emergency management in the political subdivisions of the State.

(b) To confer upon the Governor and upon the executive heads or governing bodies of the political subdivisions of the State the emergency powers provided in this chapter.

(c) To assist with the rendering of mutual aid among the political subdivisions of the State and with other states and to cooperate with the Federal Government with respect to carrying out the functions of emergency management.

2. It is further declared to be the purpose of this chapter and the policy of the State that all functions of emergency management in this state be coordinated to the maximum extent with the comparable functions of the Federal Government, including its various departments and agencies, of other states and localities and of private agencies of every type, providing for the most effective preparation and use of the nation’s workforce, resources and facilities for dealing with any emergency or disaster that may occur.

Nevada Policy’s Robert Fellner, author of the report, held no punches when describing the ways Governor Sisolak has misled the public and abused his emergency authority under NRS 414.

One example includes the governor’s false claim in Executive Order #35 that NRS 414.060 grants him the power to direct and control the movement of the general public. The actual text of the statute grants no such power to the governor, but instead merely states that the governor may cooperate with federal or state officials on emergency management issues affecting both the state and nation.

“A statute that merely authorized the governor to cooperate with other state and federal government agencies during an emergency does not permit Governor Sisolak to control the conduct of private citizens in their own homes,” Nevada Policy Vice President Robert Fellner said.

When read in their full context, it is clear that the Emergency Powers statutes are confined to those emergencies in which immediate action is required, such as military attacks from a foreign entity, natural disasters, and so forth.

“Needing to cooperate with the President or neighboring states about how to direct traffic and the movement of the general public makes sense during the kinds of emergencies contemplated by the Act, such as a missile attack or catastrophic natural disaster of some sort,” Fellner said.

The governor is simply wrong when he claims that this statute provides him with the authority to control the conduct of private citizens in their own home, according to Fellner.

The governor is simply wrong when he claims that this statute provides him with the authority to control the conduct of private citizens in their own home, according to Fellner.

“As the recipient of these emergency powers, it is unsurprising that Governor Sisolak has adopted the position that the Act provides him with a seemingly unlimited range of powers for an indefinite duration, based merely on his say-so,” Fellner said.

“While a close review of the text and legislative history of the Act reveals this to be an utterly absurd claim, the Nevada Constitution forecloses the concept entirely.

“The framers of the Nevada Constitution were acutely aware of the folly of trusting government officials to restrain themselves, which is why they created a system of divided Government, and expressly forbid any one person or body from possessing the power to both write and execute the law,” Fellner added.

Fellner ultimately included a three-pronged approach for reforming the Emergency Powers of the Governor Act—the original, authorizing legislation offering protection to Sisolak’s ongoing, tyrannical rule:

Item #3 on Fellner’s list of needed reforms segues nicely into our next section..

>>>Return to Table of Contents

Clearly, the emergency powers provided to Governor Sisolak in NRS 414 contain one major omission: a time limit.

This is perhaps the most deficient part of current NRS 414 law. That fact notwithstanding, when these flawed provisions were publicly acknowledged as the pandemic continued to spread into 2021, the majority party in the legislature showed no interest in reacquiring its legislative authority by reining-in the governor’s emergency powers.

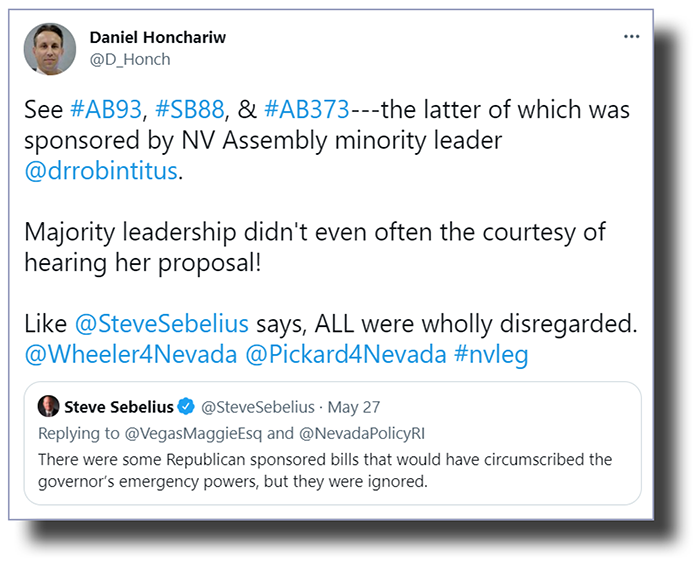

Three specific pieces of legislation were introduced—each intended to restrict a governor’s emergency powers to a certain duration in the absence of legislative consent. However, all three suffered swift legislative deaths.

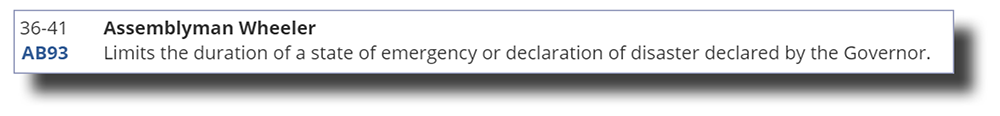

Assemblyman Jim Wheeler made the first legislative salvo in this battle. His bill-draft request (BDR 36-41), which sought to “[limit] the duration of a state of emergency or declaration of disaster declared by the Governor,” was made on March 18, 2020, mere days after the governor invoked his one-man rule.

That BDR ultimately generated Assembly Bill 93, which called for the automatic termination of a governor’s emergency powers after 15 days—after which, the legislature must approve via simple resolution a measure to “expressly allow [its] continuance.”

Unfortunately, both for the rule of law and the integrity of our public institutions, Wheeler’s legislation—which garnered 13 additional sponsors and co-sponsors—was wholly ignored by his Democrat colleagues in the majority. Chairman Edgar Flores of the Assembly Government Affairs Committee wouldn’t allow the merits of this bill to be debated publicly—refusing to give it even a single committee hearing. The bill succumbed to its death as the first deadline (“committee passage”) of the 2021 legislative session arrived on April 9.

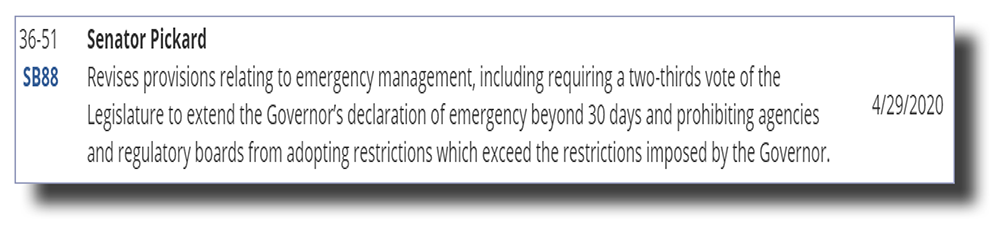

Only weeks after Wheeler’s BDR was submitted, Senator Keith Pickard followed-up with a proposal of his own in the senate, which would impose similar limits on the governor’s emergency powers without legislative consent and/or authorization:

Unlike Wheeler’s Assembly Bill 93, Pickard’s Senate Bill 88 proposed a more aggressive 2/3 vote-requirement from the legislature to extend a governor’s emergency powers. However, in a sense, Pickard’s proposal was also less aggressive in that it allowed a governor to wield emergency powers for a longer duration (30 days) before being “checked” by the legislature.

In the end, of course, details didn’t matter. Democrats on the Senate Government Affairs Committee, like their assembly counterparts, failed to provide a committee hearing for SB88. The bill, like AB93, died with Nevada’s first legislative deadline in April.

Likely frustrated by Democrats’ outright refusal to debate the merits of the prior two proposals meant to rein-in the governor’s perpetual state of emergency, Assemblywoman and minority leader Dr. Robin Titus introduced legislation again seeking to insert a time limit on the governor’s emergency powers—15 days, as with Jim Wheeler’s AB93— as well as provide more deference to localities in determining what restrictions should or should not be enforced by law.

The message from Dr. Titus was clear: You ignored my colleagues’ proposals . . . As minority leader of the assembly, will you, at the very least, entertain mine?

It is often customary for the majority to defer to its minority leaders when prioritizing legislation, but such was not the case here. Titus’ proposal—Assembly Bill 373—was similarly ignored and was killed by the same April deadline due to lack of action.

The consequences of Democrats’ unwillingness to restrict a governor’s emergency authority will likely be felt for generations, as Governor Sisolak has far-exceeded the emergency powers designated to him under NRS 414.

The precedent for over-arching, perpetual, unilateral rule has been set. Will the next “emergency” invoked by a Democrat governor, pursuant to NRS 414, concern climate change, for example? Similarly, a Republican-elected governor may be attracted to the idea of declaring an “emergency” for sweeping educational choice.

Both issues might sound like red meat for certain core constituencies, but process matters. Being mindful of the integrity of Nevada’s three-branch system—the foundation for our representative democracy—must be prioritized over potential policy victories, no matter how large.

As such, it is imperative that lawmakers, when they reconvene in 2023 for the regularly scheduled legislative session, continue to advocate for limitations on a governor’s emergency authority.

Governor Sisolak’s continued violation of Nevada’s system of checks and balances cannot, and should not, be allowed to stand.

>>>Return to Table of Contents

The increasing influence of organized labor—particularly, public-sector unions—throughout every facet of Nevada’s legislative process was again apparent during the 2021 session.

As a general rule, legislation which was vehemently supported by labor unions—both public and private—succeeded, while bills fiercely opposed by labor unions were wholly ignored by the Democrat majority.

The dominance of organized labor in the policymaking process is rooted in two truths:

- Nevada’s laws overwhelmingly defer to the interests of organized labor; and

- Labor unions have long been among Democrats’ largest donors.

As such, Democrats realize that a “nay” vote on any union-prioritized legislation will likely draw a primary challenge in the next cycle. The influence—or outright hegemony, more accurately— is so great, in fact, that multiple bills with overwhelming public support were outright ignored by the Democrat majority from Day 1 of the legislative session through sine die on Day 120.

Perhaps most frustrating about unions’ influence in killing legislation they oppose is, more often than not, unions’ interests do not align with those of the taxpayers government is ostensibly designed to serve.

Reflecting this, most of the crucial reforms to bolster the quality of education provided in Nevada—opposed vigorously by teacher unions, in particular—never saw the light of day in committee.

Nevada’s K-12 education establishment has, for years, fulminated about its perceived lack of funding to justify its miserable student-performance metrics.

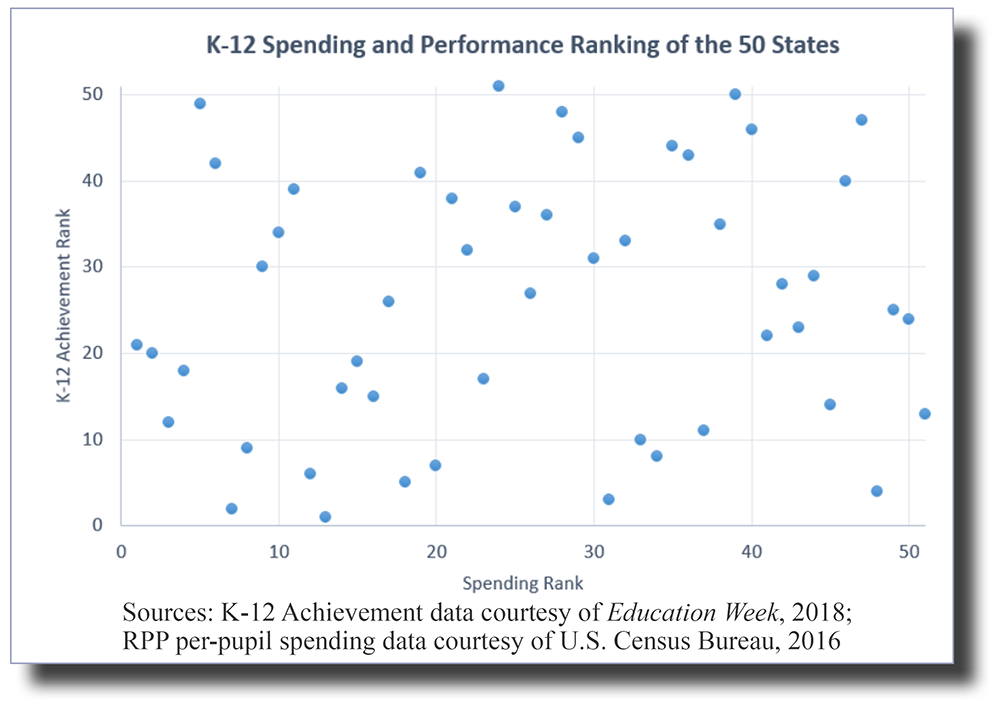

Needless to say, this ignores the entirety of evidence which indicates, quite convincingly, that per-pupil spending is a rather worthless indicator of student achievement—with many comparable states (such as Arizona, Colorado, Idaho, North Carolina, Tennessee, Texas, Utah and and Florida) ranking higher in academic performance.

Indeed, as the adjacent scatterplot makes clear, per-pupil spending correlates weakly with student performance.

Nevada Policy, of course, is fluent in this research and understands the dynamics at play:

Simply spending more money is no guarantee of improved student learning. Other factors beyond per-pupil spending, such as accountability reforms, performance-based evaluations and educational choice programs, have been empirically proven to increase academic performance — as well as boost other important measures such as college enrollment, civic engagement and parental and student satisfaction.

Acknowledging this reality is paramount to improving the quality of education offered within the Silver State.

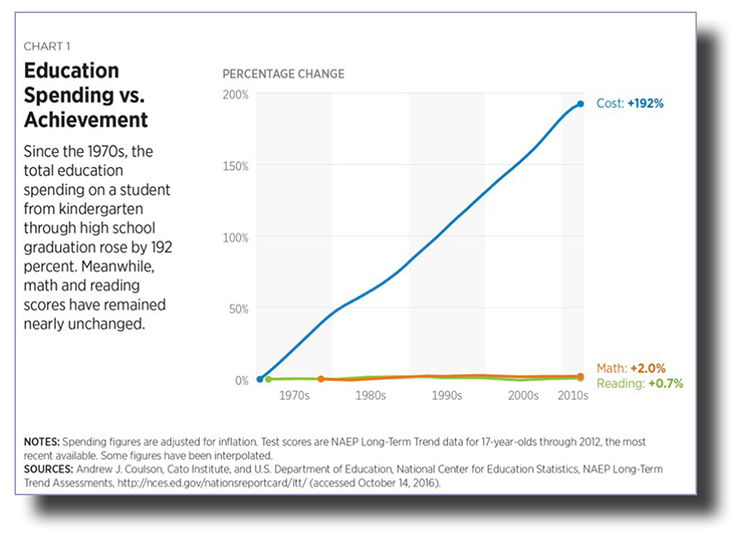

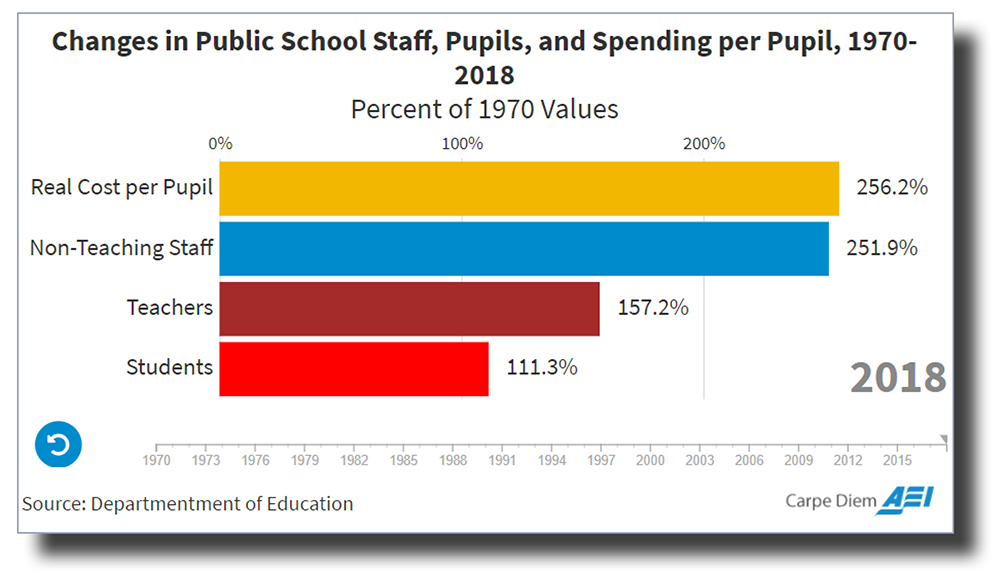

As demonstrated by the chart below (generated by the Cato Institute), continuing to increase K-12 funding, without structural reform, will not markedly improve student achievement.

That the taxpayer burden of public education has nearly tripled since the 1970s, while student performance has remained relatively flat, strongly suggests more public spending will not produce substantive results regarding student outcomes. Again, the inference to be drawn is clear: More money is *not* the answer to that which ails Nevada’s K-12 system!

Indeed, as Nevada Policy has long-opined, it is a lack of accountability—not funding—which keeps Nevada’s K-12 government-school monopoly floundering.

Writing for the Las Vegas Review-Journal, Nevada Policy’s Robert Fellner recently opined:

Nevada is projected to spend $10,197 per student this [2019-2020] school year, which reflects a near tripling in inflation-adjusted, per-pupil education spending since 1960.

Sadly, this dramatic increase in spending has not translated to improved results. Nevada schools consistently rank among the worst in the nation, with only 28 percent of eighth-grade students ranked as proficient or better in both reading and math.

Some blame this continued failure on allegedly insufficient funding and argue that things won’t get better unless Nevadans agree to pay substantially higher taxes.

But there is little evidence to support the claim that higher taxes and more spending will translate to better results. In fact, a recent study commissioned by the Legislature found that the amount Nevada currently spends — including both state and local expenditures — is already sufficient “to ensure all students can meet all state standards and requirements.”

Rather than seeking to burden Nevadans with a massive tax hike that is unlikely to boost performance, reformers should instead focus their efforts on addressing the root cause of the problem: the system’s complete lack of accountability.

Take, for example, the so-called evaluation systems used by the Clark County School District.

More than 100 district schools have for years received failing grades from the state, including at least one school where an incomprehensible 99 percent of students are below grade level in math.

Yet in a twist that would make Orwell proud, school officials claim that the district hasn’t had a single ineffective principal or administrator anywhere for at least the past four years (No bad principals in Clark County, evaluators say).

Fellner’s points are compelling and backed by the facts, especially when one understands how additional tax revenues for public K-12 have been historically spent.

As reflected by the American Enterprise Institute’s breakdown of per-pupil spending, the growth in “non-teaching staff” has far outpaced direct spending on teachers and students for decades. Is it any wonder that student performance has stagnated as districts have become increasingly top-heavy with administrators, the “diversity bureaucracy,” etc.?

As reflected by the American Enterprise Institute’s breakdown of per-pupil spending, the growth in “non-teaching staff” has far outpaced direct spending on teachers and students for decades. Is it any wonder that student performance has stagnated as districts have become increasingly top-heavy with administrators, the “diversity bureaucracy,” etc.?

Moreover, calls for increased K-12 spending neglect the well-documented demand for more schooling options!

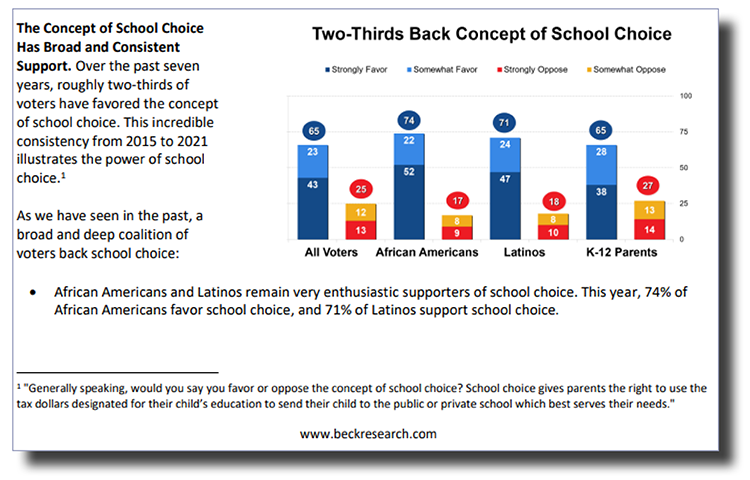

Public support for school choice policies, wherein families can utilize public funds to find the best-fitting educational environment for their children, has been both overwhelming and consistent for years. Parents have made it crystal clear: They are desperate for choices!

As the below chart indicates, overwhelmingly majorities across all demographical groups support the concept of school choice. Even more noteworthy, school-choice policies are supported most by minority groups.

Nationwide support for expanded school-choice programs has only strengthened during the COVID-19 pandemic and the related school closures. Now more than ever, Nevada families are recognizing the myriad deficiencies of the state’s one-size-fits-all government-school monopoly, and are begging lawmakers for help!

Writing for the Las Vegas Review-Journal in August 2020, in the midst of pandemic restrictions and school closures, Fellner made the following observations:

Imagine how much more manageable the current budget crisis would be if the Legislature funded Nevada’s Education Savings Account (ESA) program in 2017, rather than killing it at the request of the teachers’ unions.

ESAs would have provided parents with $5,700 to spend on any educational option of their choice, allowing all Nevadans, not merely the wealthy, to give their child an education tailored to their unique needs. And with Nevada currently spending over $10,000 per-pupil to fund the public-school system, ESAs would also generate significant taxpayer savings.

Further, the budgetary flexibility of this approach would have allowed the Legislature to make any necessary cuts in a manner that minimized their damage, rather than concentrating the harm on the most vulnerable, as was done here.

When Nevadans were asked about ESAs in a 2019 poll by EdChoice, 73 percent of the more than 1,200 respondents favored such a plan. Of the parents who answered, 82 percent supported ESAs.

The teachers’ unions and other beneficiaries of the current monopoly system, however, fiercely oppose such changes, fearing that it would reduce the total number of dollars that flow to the public-school system. While this objection may be true in a narrow sense, it also rests on the assumption that students should remain trapped in a school that doesn’t work for them just so the public-school system can collect more tax revenue. It’s unlikely most parents share that view.

Polling clearly suggests that parents across the nation agree. Evident by a June 2021 poll conducted by RealClear Opinion Research, and as proudly proclaimed by the American Federation for Children—a nationwide leader in advancing educational choice—”Support for school choice in America continues to soar.”

[P]olling more than 1762 registered voters, a majority support school choice (74% vs. 16% opposed) while 10% are unsure. This is true across party lines, with 83% of Republicans, 69% of Independents, and 70% of Democrats saying they strongly or somewhat support school choice. (Emphasis added.)

Additionally, a majority of voters (66%) say that some or all of the COVID funds the federal government set aside for K-12 education should be directed by parents. Most voters in both parties agree parents should direct all or some of the funding.

These results represent a marked increase in support for school choice since similar polling was conducted in April 2020. Overall support has increased from 64% to 74%; public school parent support has increased from 68% to 80%; Democrat support has increased from 59% to 70%. (Emphasis added.)

That fact notwithstanding, the political leverage of organized labor guaranteed a swift death to virtually any legislation introduced for the purpose of expanding educational opportunities in Nevada.

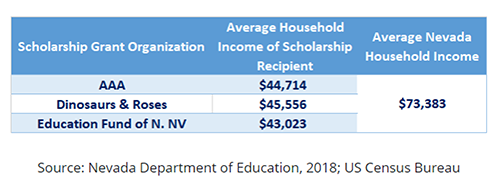

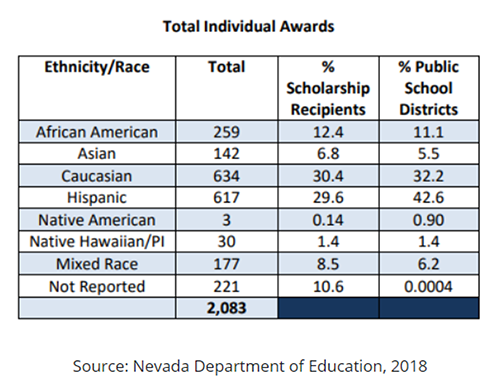

Second-term Assemblyman Gregory Hafen of Pahrump, for example, introduced Assembly Bill 242 to offer a lifeline to the scholarship recipients of Nevada’s only private school-choice program, the Nevada Educational Choice Scholarship Program (aka “Opportunity Scholarships”).

First authorized in 2015, Opportunity Scholarships provide tax credit-financed scholarships to lower-income families which can be used toward paying tuition at a private school of their choice.

Though enrollment in the program is restricted by current law—of more than 500,000 K-12 students in the public school system, less than 3,000 students have been offered a scholarship—it’s important to note that Opportunity Scholarships overwhelmingly benefit low-income, often minority families who would otherwise have no ability to escape the public schools for which they’ve been locally zoned. In fact, families are not even eligible for the program unless they earn less than 300 percent of the Federal Poverty Line, as prescribed by the original, authorizing legislation.

Assemblyman Hafen’s proposal, Assembly Bill 242, would’ve injected additional funding into the program, whereas Democrats, influenced by their union ‘advisors,’ had previously legislated to reduce the scope of the program—literally revoking hundreds of students’ existing scholarships and forcing them back into their previous public schools which weren’t working for them.

Assemblyman Hafen’s proposal, Assembly Bill 242, would’ve injected additional funding into the program, whereas Democrats, influenced by their union ‘advisors,’ had previously legislated to reduce the scope of the program—literally revoking hundreds of students’ existing scholarships and forcing them back into their previous public schools which weren’t working for them.

Needless to say, Hafen’s AB242 was outright ignored by the majority.

Similarly, Sen. Gansert’s Senate Bill 157 sought to remedy the tragic outcomes mentioned above by removing certain harmful provisions from law—granting more flexibility for scholarship-seekers and scholarship-granting organizations (SGOs) regarding current and future finances, thereby allowing for increased participation in the program. Unsurprisingly, Sen. Gansert’s proposal never saw the light of day.

A final legislative salvo aimed at expanding educational choice in Nevada came from long-time ESA proponent Senator Hammond. His proposal to reimplement Nevada’s short-lived Education Savings Accounts program, Senate Bill 306, was certainly the most aggressive and wide-sweeping school-choice legislation introduced this session. Essentially, Hammond’s legislation inserted the statutory changes necessary to fund the program, because it was on this basis that Nevada’s universal (read: available to everybody) ESA program was ultimately struck down by the courts in 2016.

A final legislative salvo aimed at expanding educational choice in Nevada came from long-time ESA proponent Senator Hammond. His proposal to reimplement Nevada’s short-lived Education Savings Accounts program, Senate Bill 306, was certainly the most aggressive and wide-sweeping school-choice legislation introduced this session. Essentially, Hammond’s legislation inserted the statutory changes necessary to fund the program, because it was on this basis that Nevada’s universal (read: available to everybody) ESA program was ultimately struck down by the courts in 2016.

Because of this, it was no surprise that Senator Hammond—like Assemblyman Hafen and Senator Gansert—never was given a committee hearing on this publicly-supported legislation.

Ultimately, as the session’s final days were winding down, lawmakers were able to reach a “grand bargain” of sorts. In effect, Assembly Bill 495—the same legislation which increased taxes on gold and silver mining—increased funding for the Opportunity Scholarship program, albeit marginally.

However, the program—which overwhelmingly caters to low-income, minority families—remains barely afloat, and will likely create more political battles in upcoming sessions as parents clamor for the limited number of scholarships available.

Organized labor can also be credited for suppressing legislation meant to bolster transparency and accountability in government.

Freshman Assemblyman and former Nevada Policy President Andy Matthews’ introduction of Assembly Bill 183 reflects how unions’ political priorities often misalign with those of taxpayers as well as many of their own members.

AB183 sought to remove the special exemption gifted to government-sector unions decades ago vis-à-vis Nevada’s Open Meeting Law (NRS 241), which in relevant part states the following:

In enacting [NRS Chapter 241], the Legislature finds and declares that all public bodies exist to aid in the conduct of the people’s business. It is the intent of the law that their actions be taken openly and that their deliberations be conducted openly. (NRS 241.010).

For decades, however, public-sector unions have enjoyed special treatment under the law, as all taxpayer-funded collective-bargaining negotiations and arbitration processes are exempt from the above transparency requirements. (See NRS 288.220 re: local-government employee unions; NRS 288.560 re: state-level employee unions.)

This is an intolerable disservice to Nevada’s taxpaying populace, as these negotiations often concern hundreds of millions of public dollars. It is, quite frankly, disgraceful that Nevada law doesn’t allow taxpayers (or even public-sector workers themselves) to witness these secretive, behind-closed-doors negotiations because we have no way of gauging how well our elected officials have represented the public’s interests.

Moreover, there is no compelling reason to exempt these negotiations, specifically. Transparency does not undermine collective bargaining, contrary to the invectives of certain union officials.

Indeed, several states that require local governments to engage in collective bargaining also require these proceedings to be open (e.g., Minnesota, Texas, Idaho). There is no evidence from these states that collective bargaining has been undermined by transparency.

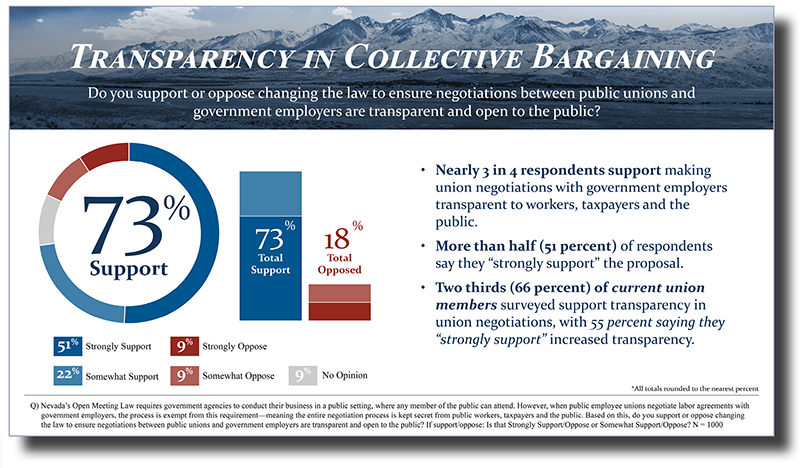

The biggest reason for optimism regarding AB183, despite the expected union opposition, was its overwhelming public support. In January 2020, Nevada Policy partnered with OH Predictive Insights to gauge popular support for the specific concept behind AB183.

The question asked of 1,000 likely Nevada voters was simple: “Do you support or oppose changing the law to ensure negotiations between public unions and government employers are transparent and open to the public?”

By a 4:1 margin, Nevada voters overwhelmingly want transparency in public-sector contract negotiations. Even more, our polling revealed that two-thirds of self-identified union households support a policy of greater transparency!

Thus, when union officials pressured Democrats to kill Matthews’ proposed reform, they were working directly against the documented interests of their own members!

This, in a nutshell, again reflects the dominating influence of organized labor in Carson City—seemingly, an elevated, ‘elite’ class under Nevada law. It is beyond unfortunate to recognize that union priorities so often take precedence over the concerns and interests of lawmakers’ constituents.

>>>Return to Table of Contents

Another of Assemblyman Matthews’ proposals, Senate Bill 276, is also noteworthy. This is so not merely because of the bill’s merits and substance, but also because the opposition to it demonstrated a recurring truth about Nevada’s 2021 legislative session regarding government and its role in the policymaking process: Government is its own, powerful, special interest.

As Nevada Policy’s Michael Schaus scribed in his now weekly Nevada Independent Sunday column,

The concept behind Assembly Bill 276, a bill sponsored by Assemblyman Andy Matthews (R-Las Vegas), is something that has attracted an ideologically diverse coalition of supporters over the years: increasing the penalties on agencies that fail to comply with Nevada’s public records law.

As Las Vegas attorney Maggie McLetchie pointed out on Twitter, when Nevada Policy Research Institute (NPRI) and the American Civil Liberties Union (ACLU) can agree on something, surely “legislators should be able to come together” on the issue. And while lawmakers might do just that, last week’s hearing demonstrated that the proposal wasn’t without its share of government-funded opposition.

A parade of taxpayer-funded agencies, lobbyists and governments railed against the bill. Matthew Christian, assistant general counsel for the Las Vegas Metropolitan Police Department, echoed other lobbyists and agency representatives when he argued that the reform would be largely ineffective at reducing litigation over open records disputes.

As Schaus explains, Assembly Bill 276 wasn’t the only instance where government lobbyists, insiders and public-sector unions fought against broadly-popular reforms.

Both sides seem to miss the way government uses its considerable influence to subvert and minimize the priorities of common citizens. And that’s a pretty damaging blind spot for the local priorities of both major political parties.

After all, it’s largely police associations and law enforcement agencies (using taxpayer dollars) that lobby relentlessly against progressive criminal justice reforms. Likewise, teacher unions and public-school districts have long spearheaded a taxpayer-funded campaign against reforms to provide low-income students with financial assistance for private educational alternatives. And, of course, it shouldn’t surprise any conservative that government agencies asking for larger budgets are among the loudest voices calling for higher taxes.

The mere fact that such lobbying is funded by taxpayers doesn’t make it any less damaging to our system of representative government than the political activity funded by corporatists and cronies in the private sector. In the end, we should all be a little more skeptical of the government-funded activism that routinely takes place during legislative sessions.

After all, whether it’s in our interest or not, we’re paying for it.

Rumor was, Matthews’ Assembly Bill 276 had the votes to pass out of committee.

Unfortunately, the chair of the Assembly Government Affairs Committee, Assemblyman Edgar Flores, denied his colleagues an opportunity to vote on the proposal—again exposing the perverse, anti-democratic influence of government’s own self-interest on the legislative process.

>>>Return to Table of Contents

It is neither a secret nor surprise that Democrat interests dominated throughout the 2021 legislative session—after all, they were in the majority. As a result, many of the session’s most controversial bills were often passed on strictly party-line votes.

Indeed, as Nevada Assembly minority leader Robin Titus lamented in a commentary for the The Nevada Independent:

The Democrats are in their second regular legislative session with their first state government-controlled trifecta since 1992. We thought this session would largely be focused on the pandemic and our bottom-of-the-nation unemployment rate. However, it has morphed into another partisan session with national priorities.

In fact, we are halfway done with the 81st legislative session and have had zero Republican bills voted on the Assembly floor:

- 0 Republican bills

- 10 Democrat bills

- 23 Democrat-led committee bills

- Assembly bills heard in committee so far:

- 103 of 183 Democrat-led committee bills have been heard (56 percent)

- 118 of 195 Democrat bills have been heard (61 percent)

- 47 of 125 Republican bills have been heard (38 percent)

We have heard from Democrat leadership that the reason Republican sponsored bills are not being heard is because they “don’t think [they] are good policy.” That is simply not the case. We have bipartisan common-sense solutions to Nevada’s problems such as our doctor and nursing shortage, access to care, education, unemployment, and so many others.

Such partisanship was not the case, however, for Senate Bill 452, whose introduction catalyzed a new coalition of diverse groups in opposition to the legislation.

Writing for The Nevada Independent, Nevada Policy’s Michael Schaus pontificated:

Given our modern political climate, it’s hard to imagine anything that would get police unions, criminal justice reformers, gun rights organizations and the American Civil Liberties Union on the same side of an issue.

However, MGM’s lobbyists (and the lawmakers influenced by their schtick) have managed to create an environment that has done precisely that in the waning days of the legislative session.

Senate Bill 452, sponsored by Senate Majority Leader and Clark County prosecutor Nicole Cannizzaro, seeks to give MGM’s corporate policy on firearms the full power of law—making it a misdemeanor to carry or possess a firearm on any casino property that has decided to ban them and a felony for individuals with multiple violations.

Co-presenting the bill with Cannizzaro in the Senate, MGM was not shy about its desire to outsource enforcement of its firearms ban to Las Vegas Metro.

Schaus went on to explain how Cannizzaro’s proposal managed to generate widespread opposition among such unlikely allies:

Cannizzaro acknowledged that a casino operator (in fact, any property owner in the state) already has the right to ban guns and ask alleged violators to leave. Nonetheless, she seems convinced that increased police interactions are necessary to make sure such policies are “something that [casinos] can properly enforce.”

However, it’s not government’s role to enforce a private company’s corporate policies—let alone invent criminal charges for anyone who runs afoul of them.

To be perfectly clear, this bill doesn’t make it “easier” for casinos to ban weapons—they can already do so at will. Instead, SB452 criminalizes even the accidental violation of a property’s firearm ban—resulting in, as the Las Vegas Police Protective Association argued, a likely increase of dangerous and even deadly police encounters with individuals otherwise legally permitted to carry firearms.

“We are trying to limit a police officer’s use of deadly force,” the LVPPA testified in the Senate. “This bill goes in the opposite direction.”

The ACLU—which is generally not accustomed to finding itself aligned with police unions—agreed with the assessment wholeheartedly. The civil rights organization has nicknamed Cannizzaro’s proposal “the casino stop-and-frisk bill” for the disparate impact such a policy would have on members of disadvantaged and minority communities.

Ultimately, the pressure exerted by this diverse coalition (and the public at large) convinced lawmakers in the Assembly to shelve this concept entirely—but only after the Senate ignored the bill’s widespread opposition among such an ideologically diverse group, and passed it in the final days of the session.

In a session with few legislative victories, and even fewer moments of diverse coalition building, Nevada Policy was happy to witness this bill’s slow-motion death in the session’s final days.

>>>Return to Table of Contents

In recent years, Nevada Policy has partnered with a broad coalition of diverse interests in efforts to remedy the ubiquitous injustices inherent to our nation’s imperfect criminal-justice system—and the tremendous taxpayer costs that accompany them. Criminal justice reform (“CJR”) is no longer a purely partisan issue, and it shouldn’t be.

Led by groups such as Right on Crime—a national initiative whose mantra is “fighting crime, supporting victims, and protecting taxpayers”—criminal-justice reforms long supported by libertarian and progressive leaders are quickly gaining popularity among constitutional and fiscal conservatives as well.

The foundational goal for such reforms is to make the system more equitable for those who endure it and more fiscally efficient for taxpayers burdened with its tremendous and steadily rising costs.

In that spirit, Nevada Policy embraced several criminal-justice-reform bills introduced during the 2021 legislative session which moved the needle in the right direction: towards fairness, due process, and fiscal responsibility. The Institute has done this while avoiding the kind of extremism that has taken hold in other jurisdictions during our modern era of “defund the police”—such as San Francisco, where a proudly-socialist district attorney has generally refused to prosecute crime, leading to catastrophic results.

Still, some positive CJR proposals sailed through the legislature with minimal resistance—a clear sign that more conservatives are rethinking their reflexive opposition to such reforms.

Democrat Assemblywoman Rochelle Nguyen introduced Assembly Bill 116 which, in her own words, “seeks to change our current system for minor traffic and other related violations from being criminal in nature to being civil in nature.”

This type of criminal-justice reform makes all the sense in the world from the perspective of a civil libertarian. What’s more, the taxpayer expense of prosecuting these rather petty crimes is tremendous and harms the public wellbeing more than it serves it.

We at Nevada Policy applaud Assemblywoman Nguyen’s introduction of Assembly Bill 116, and were thrilled to see the proposal pass out of both legislative chambers on near-unanimous bases.

Perhaps the most substantive CJR victory during the 2021 session was Attorney General Aaron Ford’s brainchild, Senate Bill 50, which sought to restrict the use of “no-knock” warrants, wherein police are permitted to enter a person’s residence without identifying themselves in advance, or announcing their intention— quite literally, to “break” into one’s home to execute the warrant.

Many of the bill’s most vocal advocates sought a complete prohibition on the use of no-knock warrants. What resulted, instead, were severe limitations on how and when these no-knock warrants can be employed.

Writing his Sunday column for The Nevada Independent, Nevada Policy’s Michael Schaus asserted the following:

Motivated to enact reform following last year’s tragic death of Breonna Taylor in Louisville, Kentucky, Attorney General Aaron Ford has introduced a proposal to restrict the use of “no-knock” raids in the Silver State.

Despite all the complexities, controversies and disagreements regarding the details of the botched raid that lead to Breonna’s death, the key takeaway was simple: When police misuse—intentionally or not—the vast amount of power they are given over the citizenry, it can result in catastrophic and tragic consequences.

And that is precisely why Ford’s proposal is a desperately needed limitation on the use of excessive policing practices. It’s also one that progressives, libertarians and conservatives should all be willing to embrace.

Progressives have long argued for such limitations on law enforcement, arguing that current practices disproportionately harm minorities and disadvantaged communities. Libertarians, for their part, have long believed that in addition to racial disparities, such practices are antithetical to the basic civil rights and protections enumerated in America’s constitutional order.

Conservatives should embrace such reforms as well. After all, a belief that government power must be limited and restrained is a core component of conservative thought—it should make no difference whether we’re talking about the power of government to tax a business, or the power for it to send state agents (authorized to use deadly force) into a private citizen’s home.

Unfortunately, conservatives have traditionally been only peripheral supporters of such limits on government’s policing powers—which demonstrates a bizarre cognitive dissonance within some corners of the movement. However, in recent years this has been changing. A growing number of conservatives have been increasingly vocal in their support for criminal justice reform. For example, Rand Paul (R-Kentucky) sponsored the “Justice for Breonna Taylor Act” last year, which would have prohibited no-knock raids nationwide.

When a conservative U.S. senator and a progressive state attorney general are echoing each other’s proposals, it is a reasonable sign that bipartisan consensus isn’t too far away.

Schaus’ musings were embraced by AG Ford—Ford even distributed the SB50 commentary throughout social media—and it certainly had an impact with regards to persuading conservatives to adopt the reform, as well.

On that basis, Nevada Policy is very pleased to report that Senate Bill 50 was passed, unanimously, in both chambers.

Civil asset forfeiture is among the most flagrantly unamerican practices to be tolerated—and in fact, actively supported—by many of our elected officials.

Under federal and state forfeiture laws, law enforcement may seize an individual’s personal property based merely on a suspected nexus to criminal activity. Property (e.g., cash, cars, etc.) can be seized and ultimately forfeited even when its owner is neither arrested nor charged of any crime—much less found guilty of one!

Most intolerable, however, is that the seizing law-enforcement agency is typically entitled to a sizeable portion of the proceeds generated by forfeiture auctions. For example, according to the Nevada Attorney General’s 2020 Aggregate Forfeiture Report, the Las Vegas Metropolitan Police Department profited to the tune of nearly $1 million based on the forfeited property they auctioned during the 2020 fiscal year.

This means law enforcement is directly incentivized to seize as much property as possible, knowing that it’ll benefit their agencies’ bottom-lines and, if they’re lucky, provide enough funding for some new toys for the department—such as the $300,000 armored vehicle recently purchased by the sheriff’s office in Linn County, Iowa. (The Institute for Justice has coined the phrase “policing for profit” to describe this perverse incentive.)

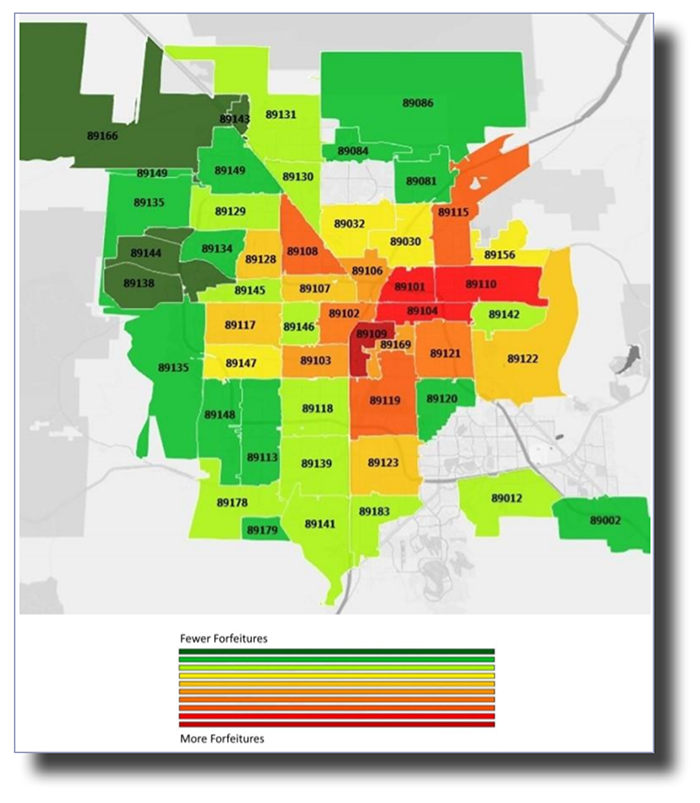

A 2017 NPRI study documented the extent to which forfeitures occur in Clark County, Nevada. Its findings were unambiguous: Forfeitures overwhelmingly take place in poorer, more diverse neighborhoods, disproportionately impacting marginalized communities.

This is particularly notable, not because Nevada Policy wishes to engage in racial politics, but rather because those wishing to contest the forfeiture of their property must spend their own time and money to do so in civil court—a process mired by due-process deficiencies. As such, this often means it is cost-prohibitive for property owners to contest the forfeiture— either because the claimant cannot afford an attorney to begin with, or because the property is worth less than reclaiming it in court would cost in legal fees. Under each scenario, a form of legalized theft is committed—with the government as the perpetrator. The victim (the former property owner) is left with no recourse or due-process protections.

This is particularly notable, not because Nevada Policy wishes to engage in racial politics, but rather because those wishing to contest the forfeiture of their property must spend their own time and money to do so in civil court—a process mired by due-process deficiencies. As such, this often means it is cost-prohibitive for property owners to contest the forfeiture— either because the claimant cannot afford an attorney to begin with, or because the property is worth less than reclaiming it in court would cost in legal fees. Under each scenario, a form of legalized theft is committed—with the government as the perpetrator. The victim (the former property owner) is left with no recourse or due-process protections.

Recent efforts (2019, 2021) by Democrat Assemblyman Steve Yeager, in particular, have offered the ideal path forward regarding how best to revise Nevada’s forfeiture laws in ways that boost the presumption of innocence and due process for the accused. Unfortunately, though his efforts have been welcomed by the Nevada Assembly on a bipartisan basis in both the 2019 (AB420) and 2021 (AB425) legislative sessions, the Nevada Senate has been controversially reluctant to implement such reforms.

Of course, this “reluctance” stems from the fact that the Senate Judiciary Committee, before which Yeager’s 2021 proposal, Assembly Bill 425, was set to be debated, was chaired by active Clark County prosecutors!

Indeed, both Senators Nicole Cannizzaro and Melanie Scheible clearly have a conflict of interest here—law enforcement agencies, including district-attorney offices, often benefit directly and indirectly from such forfeitures.

Even beyond the clear conflict of interest, however, is a more fundamental issue: That of constitutional separation-of-powers requirements. In our American system of government, it is understood (and codified in our state constitution) that those charged with writing the law cannot also be charged with enforcing the law. And yet, that is precisely what occurred in 2021.

Realizing that Yeager’s proposal would die on arrival in the senate—if it even got that far, which it didn’t—Nevada Policy nevertheless testified in support of Assembly Bill 425 before the Assembly Judiciary Committee.

As expected, Yeager’s AB425 was well-received by the committee, but that’s as far as the process went. Alas, forfeiture reform was, for at least the third consecutive session, killed by Clark County prosecutors.

This realization is even more frustrating when recognizing that Nevada’s state constitution has an explicit, plain-language, prohibition against so-called “dual servants.”

>>>Return to Table of Contents

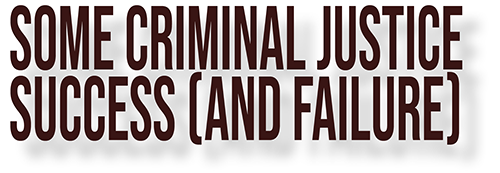

The previous section, wherein prosecutors concurrently serving as lawmakers were shown to have killed legislation which would directly affect their duties and responsibilities within the executive branch, provides an ample segue into the myriad constitutional violations on display by the 2021 Nevada Legislature.

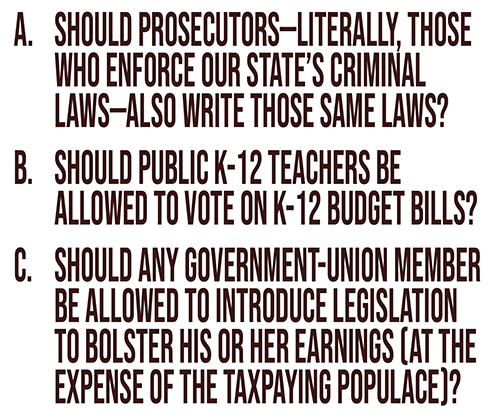

The conflict which arises from so-called “dual servants”—those who work, simultaneously, in two branches of government (i.e., the Executive and the Legislative)—is obvious when placed in the following contexts:

These are just a few reasons why Article 3 of Nevada’s state constitution explicitly forbids public employees from serving in two branches of government, concurrently, all of which prompted Nevada Policy to file litigation against the approximately 11 legislators who retained their executive-branch position after being elected to the 2021 Nevada Legislature.

As Nevada Policy outlined when it filed its lawsuit against these unconstitutional dual servants,

Nevada’s Separation of Powers doctrine divides the powers of the government into three distinct categories: Legislative, Executive and Judicial.

Pursuant to the Nevada Constitution, “no persons charged with the exercise of powers properly belonging to one of these departments shall exercise any functions, appertaining to either of the others.” [See Article 3(1)(1) of the Nevada State Constitution]

Yet, for years numerous Nevada government employees have simultaneously served as state legislators, in plain violation of Nevada’s Separation of Powers doctrine.

This practice has undermined the principle of representative government and eroded the Legislature’s ability to truly serve the public interest.

After all, few would support rules that limit their own power, which is precisely why the power to write the law must be kept separate from those tasked with enforcing it.

The conflict of interest that results from government employees serving as legislators has led to a Legislature that serves the needs of government, rather than the needs of ordinary Nevada citizens and taxpayers. This means higher taxes, bloated bureaucracies and reduced governmental accountability and educational choice.

This is why Nevada Policy has filed a lawsuit requesting the courts to finally enforce Nevada’s Separation of Powers doctrine and prohibit anyone from serving in multiple branches of government at the same time.

The timeline of events below indicates just how long this unconstitutional practice has been permitted in Nevada. Our elected officials have been running afoul of the state constitution for decades.

>>>Return to Table of Contents

The long and strategic political process which ultimately resulted in the passage of Assembly Bill 495, which markedly increased the taxpayer burden upon the silver and gold mining industries, truly began in January 2020.

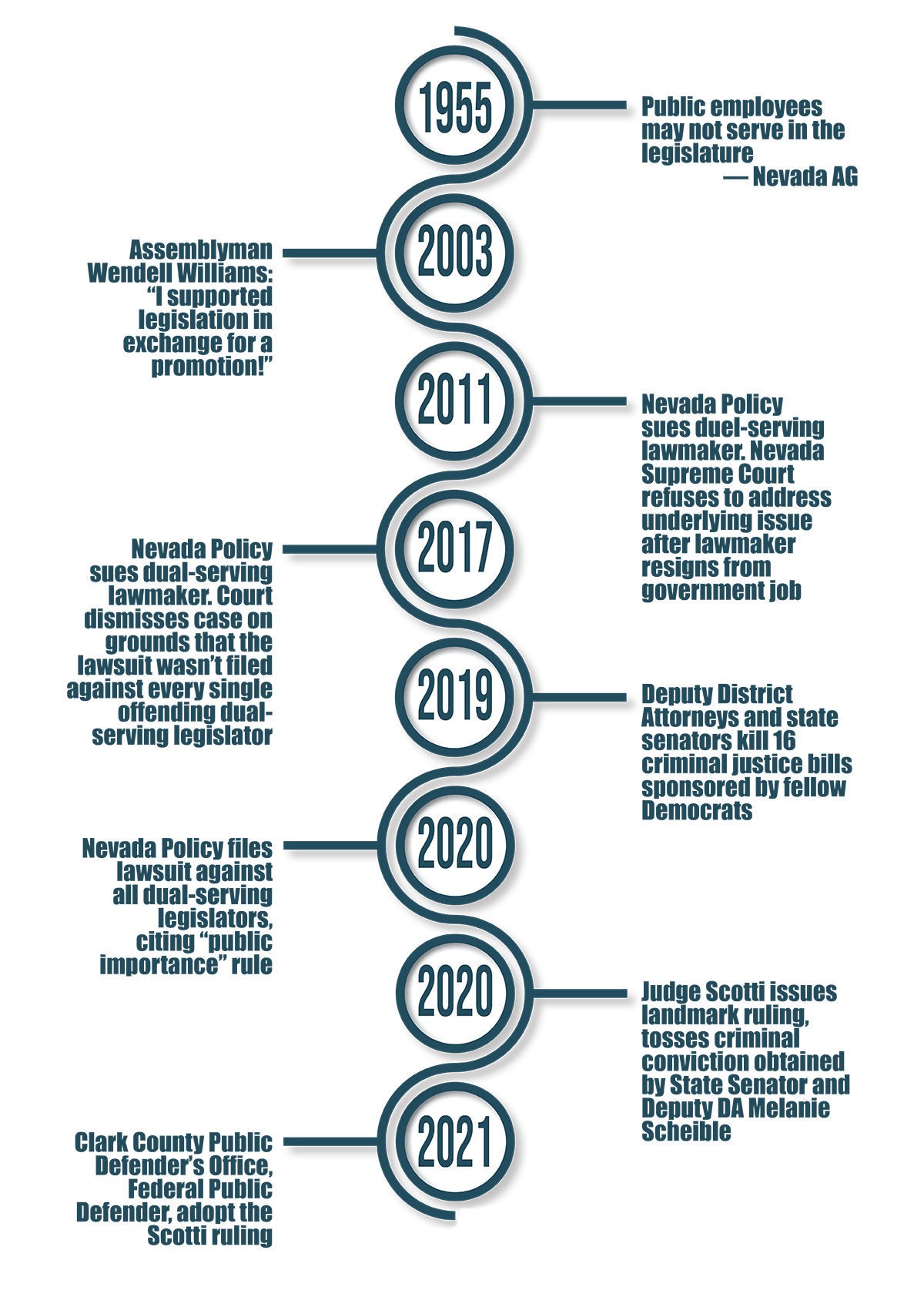

It was then that the Clark County Education Association, the state’s largest teachers’ union, declared its intentions to push two statewide ballot initiatives—both proposing significant tax increases—for the explicit purpose of “adequately” funding public K-12 in Nevada.

Its first initiative to be announced was an increase to the state’s gaming tax. It specifically proposed to increase the top-bracket rate on gaming entities from 6.75 percent to 9.75 percent—resulting in a would-be 44 percent increase—which was expected to produce $340 million in new annual revenues. (Never mind that gaming revenues already accounted for more than $950 million of Nevada’s 2019 General Fund budget of $4.42 billion, or more than 20 percent.)

Its second initiative sought to implement a massive increase to Nevada’s base sales-tax rate which, if enacted, would give Nevada the dubious distinction of levying the highest average sales tax (on a weighted-average basis) across the nation.

Essentially, both of CCEA’s proposed initiatives were a conspicuous challenge to the 2021 Nevada Legislature: Enact one of our proposed taxes, or let voters decide for themselves on the 2022 ballot!

That’s because, under Nevada law, initiatives which successfully garner the requisite number of signatures will land on the next election cycle’s statewide ballot *unless* the legislature adopts the policies therein, verbatim, in the subsequent legislative session. In other words, Nevada legislators knew that, unless they formally introduced these taxes within the session’s first 40 days, they would land on the 2022 ballot.

The political calculus here changed dramatically during Summer 2020, however. It was during last summer’s second Special Session that Democrats passed three resolutions, all aimed at increasing taxes on Nevada’s mining industry by upwards of $540 million per year.

As reported by April Corbin Girnus of the Nevada Current:

Assembly Joint Resolution 1 & Senate Joint Resolution 1 would both tax mining on 7.75 percent of their gross proceeds of minerals. Currently, mining companies are taxed on their net proceeds of minerals and the tax rate is capped at 5 percent.

AJR1 would send 75 percent of revenue raised to the state general fund and 25 percent to a new account to be used for educational purposes, health care or economic assistance for residents. SJR1 would send 50 percent of revenue raised to the state general fund and 50 percent to a new program that makes payment to residents, presumably like an Alaska-style dividend.

Both resolutions would make it so only a simple majority is needed in both houses of the Legislature to increase the tax rate but a two-thirds majority is required for lowering the tax rate — a reversal of the state’s existing two-thirds rule for passing any tax increase.

The Democrats’ third proposal, Assembly Joint Resolution 2, was promoted as a compromise between competing interests—it proposed to increase taxes on mining by about $170 million per year. Reported again by Girnus,

Assembly Joint Resolution 2 would raise the tax cap from 5 percent to 12 percent of net proceeds. The proposal was introduced as an “olive branch” to the mining industry, said Speaker Jason Frierson. Newmont Corp. and Barrick Gold Corp., the world’s largest two gold mining companies that operate together in Nevada under a joint venture called Nevada Gold Mines, testified in neutral on the bill, with representatives saying they appreciated having a seat at the table and working with legislators. The Nevada Mining Association also testified neutral on AJR2.

Each one of these proposals required passage by both chambers in two consecutive legislative sessions before being put before voters as ballot questions. Given Democrat control of both chambers, this meant the mining industry was facing the very real possibility of seeing massive new tax hikes put on the ballot—certainly a “worst case scenario,” as far as much of the industry was concerned.

As a result, a coalition of interests—namely, organized labor and gaming— converged upon mining representatives to pitch a last-minute agreement which would guarantee those three initiatives would not go to voters to decide should the industry agree to more modest tax increases.

Ultimately, Assembly Bill 495 was the agreement reached—behind closed doors, and with virtually no public involvement.

AB495 proposed to increase taxes on gold and silver mining, exclusively, via rate increases to the existing gross-receipts taxes levied upon the industry. (Democrat majority leader Assemblyman Frierson posited the new taxes will generate upwards of $170 million per biennium.) Accordingly, it removes the possibility that any of the three mining-tax-related resolutions passed during Summer 2020 will appear on the 2022 ballot (due to inaction during the 2021 session). Equally salient in this agreement, the CCEA agreed to withdraw its two proposed tax initiatives from the 2022 ballot as well.

Republicans were able to garner at least a few concessions from Democrats—including increased funding for Title 1 charter schools, a financial lifeline to the state’s woefully-underfunded private educational-choice program (“Opportunity Scholarships”), and an agreement to effectively kill Democrat Sen. Roberta Lange’s proposal to allow for straight-ticket ballots.

Given the influx of federal dollars for pandemic relief—totaling approximately $6.7 billion—Nevada Policy lobbied fervently against this “grand bargain.” The Institute perceived no need to increase revenues, particularly because lawmakers did not yet fully understand how and where those federal-grant dollars could be spent.

Moreover, Governor Sisolak submitted a balanced budget to the 2021 Nevada Legislature which did not call for new, major revenues. Not to mention, the Economic Forum boosted its revenue forecast dramatically, mid-session—further indicating no “need” for tax hikes of any sort.

As reported by the Las Vegas Sun on May 4, 2021,

The five members of the state Economic Forum approved projections that suggest the return of tourists to the casinos and resorts that power Nevada’s economy would provide roughly $9.1 billion in general fund revenue over the next two years, which is $586 million more than originally expected.

Notwithstanding this new influx of cash, Democrats successfully persuaded enough of their GOP colleagues to pass this tax with the requisite two-thirds vote in both chambers.

On the assembly side, Republicans Jill Tolles and Tom Roberts voted in favor of the tax—providing the two votes necessary to reach the two-thirds threshold. On the senate side, votes of “yea” well surpassed the needed two-thirds threshold due to support provided by Republican Senators Hammond, Kieckhefer, Pickard, and Seevers Gansert, all of whom, for their own reasons, voted to implement the new mining tax.

It is thus no surprise that the six GOP lawmakers mentioned above fared worse than most of their Republican colleagues on Nevada Policy’s 2021 Legislative Rankings.

>>>Return to Table of Contents

Sen. Dallas Harris (D)

Sen. Harris’ Senate Bill 150 caught Nevada Policy’s attention due to its apparent recognition of the beneficial effects of market forces on the availability of affordable housing. Her proposal to permit “tiny houses” through de-zoning should’ve been viewed as the preferred type of reform for tackling Nevada’s affordable-housing shortage. Instead, we were saddened to see the bill was rejected in its original form and morphed into something else entirely.

Sen. Carrie Buck (R)

Democrats generally impeded Senator Buck’s legislative proposals from ever seeing the inside of a committee room. Nevertheless, we applaud Senator Buck for her introduction of Senate Bill 152.

Inspired by the Goldwater Institute’s Academic Transparency Act, Buck’s proposal sought increased transparency regarding Nevada’s public K-12 curriculum. In an era when such controversial teachings as Critical Race Theory and the New York Times’ 1619 Project are gaining momentum, parents need to fully understand and recognize what is being taught to their children, and how.

Asm. Glen Leavitt (R)

Nevada Policy was taken aback when it realized Assemblyman Glen Leavitt, a Republican from Boulder City, introduced a *new* tax (Assembly Bill 287) for certain heavy machinery—eerily similar to the tax he formerly introduced during the 2019 session (Assembly Bill 388). The continued embrace of higher taxes and spending by Nevada’s supposed “fiscal conservatives,” is a reminder of how a fully Republican government in 2015 nonetheless resulted in the largest tax hike in state history.

Attorney General Aaron Ford (D)

AG Ford deserves recognition for his influence on the legislative process to ensure the passage of Senate Bill 50, which limits when and how law enforcement will be permitted to utilize so-called “no-knock warrants.” We applaud AG Ford for his advocacy of commonsense criminal-justice reforms like SB50, and look forward to his continued efforts.

Asm. John Ellison (R)

Nevada Policy applauds John Ellison for his introduction of Assembly Bill 99, which sought to increase the threshold at which prevailing-wage rates apply for Nevada’s public-works projects.

Despite clear evidence that prevailing wages are absurdly higher than the market, Democrats remained unpersuaded by such arguments. In fact, Vice Chair Selena Torres went so far as to recommend a conceptual amendment that would *decrease* the threshold at which prevailing-wage mandates apply—in essence, reversing, entirely, the legislation proposed!

Asm. Steve Yeager

Nevada Policy recognizes Criminal-Justice champion Steve Yeager, who tried valiantly to reform Nevada’s laws governing the pernicious and constitutionally-defective law enforcement practice known as civil asset forfeiture.

Though his attempt was squashed by senate Democrat leadership, we applaud his commitment and, should he return to the Assembly in 2023, we urge him to reintroduce this critical reform.

Aswm. Annie Black

Freshman Assemblywoman Annie Black of Mesquite certainly ruffled her colleagues’ feathers throughout the 2021 session. At one point, in protest of the arbitrary mandates imposed during the legislative process, Black refused to “mask-up” on the assembly floor—resulting in a vote for her official censure (along strictly party lines). As a result, Black lost her voting rights for a sustained period during a crucial stretch of the session, much to the chagrin of several members within the GOP assembly caucus.

Republican colleagues surely missed her presence as they tried their best to stop a slew of aggressive Democrat proposals. Nevertheless, Black’s persistent effort to increase transparency and public access during the legislative process deserves applause—even if she didn’t always comply with the legislature’s procedures.

Notably, Aswm. Jill Dickman also participated in the protest in her own way: by voting from her office where she wasn’t required to wear a mask, declaring, “I am not sharing my personal medical information with anyone. Apparently we have de facto vaccine passports in the Legislative Building.”

>>>Return to Table of Contents

>>>Click here for the full calculations spreadsheet<<<

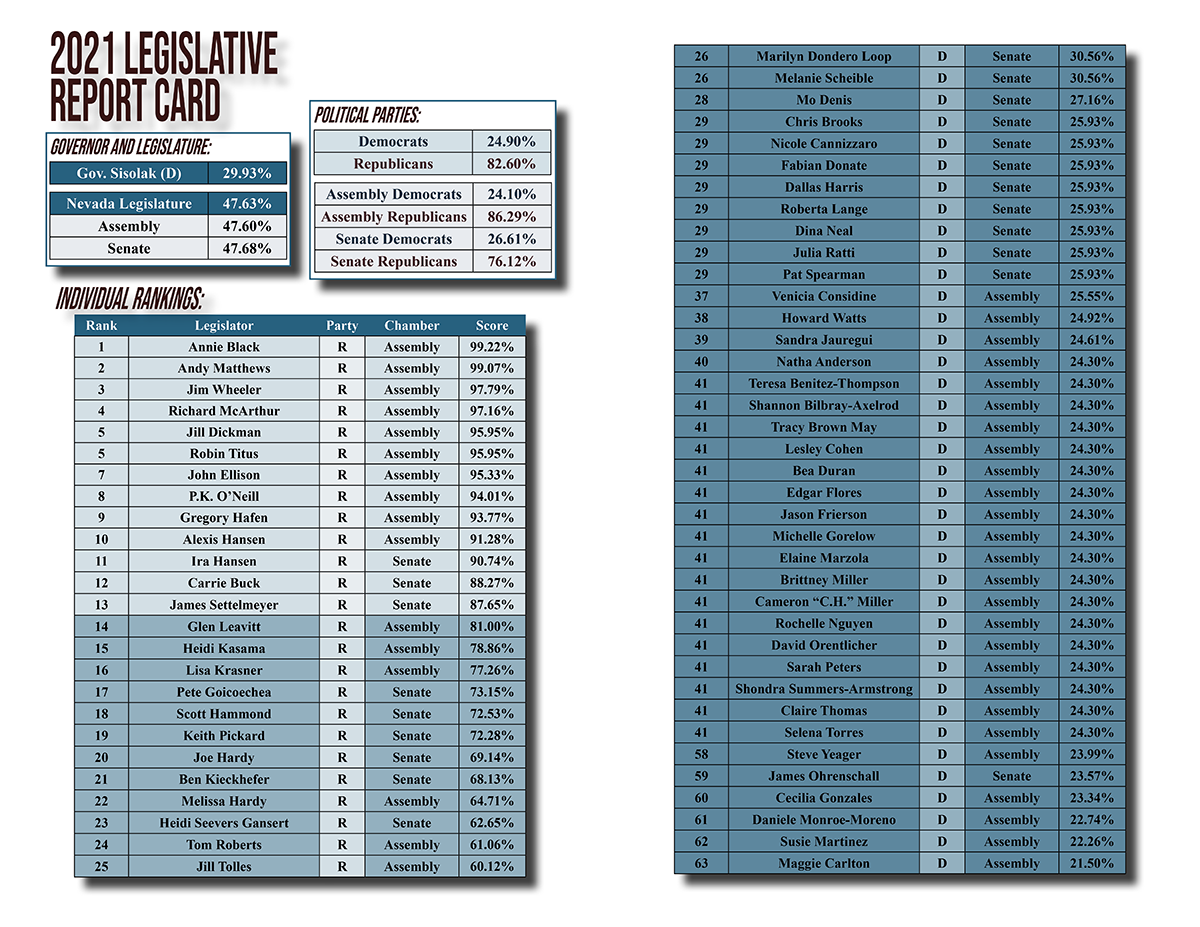

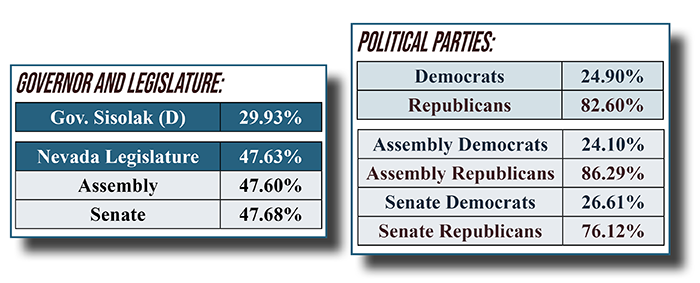

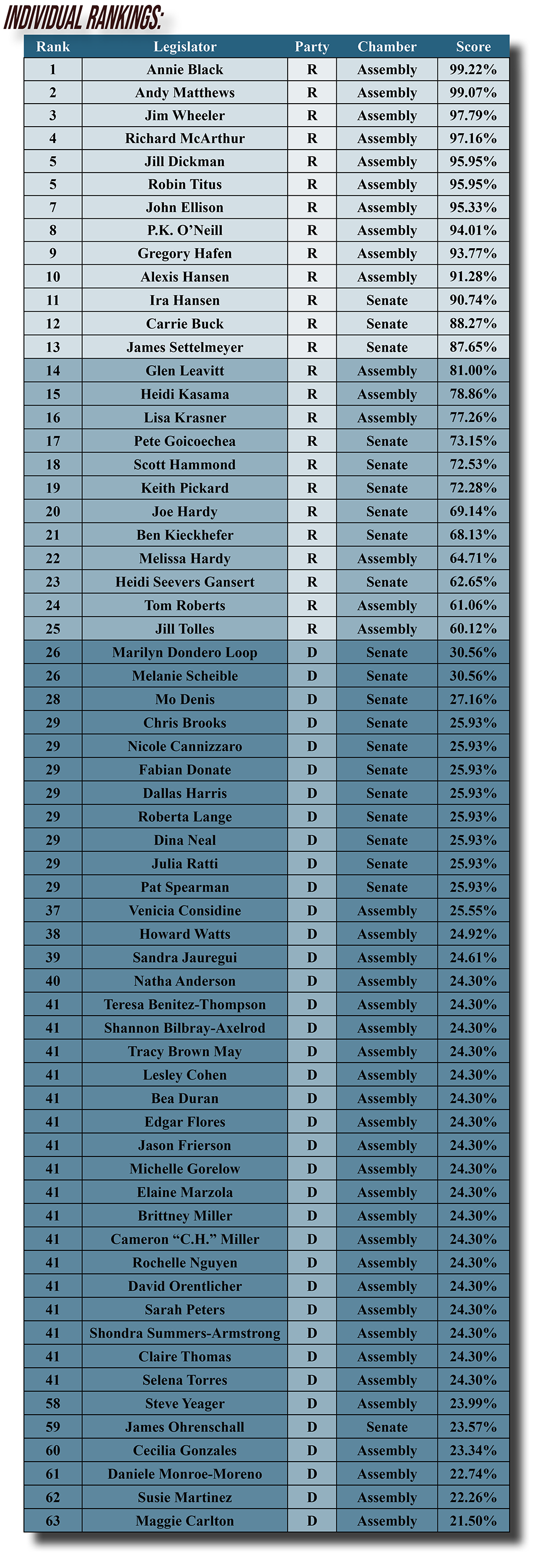

Because most Nevadans do not have the time to follow the individual performances of their representatives in the Nevada Legislature, Nevada Policy keeps track throughout the session. The following report card provides an objective measure of each lawmaker’s voting record on legislation impacting the degree of economic freedom and needed policy reforms.

The grading system is an adapted version of that used by the National Taxpayers Union to grade Congress. A key advantage of the NTU methodology is that it allows bills of greater significance to be weighted accordingly. Thus, each bill impacting Nevada tax rates, either directly or indirectly as the result of spending beyond available revenues, is assigned a weight of 1 through 100, depending on magnitude of impact. Also considered are bills that would create hidden taxes through costly regulation and bills that provide targeted tax subsidies to politically favored recipients.

It should be noted that some legislative proposals can reduce the tax burden — either by lowering tax rates directly or by curtailing spending. Lawmakers can gain points by voting for such proposals. Lawmakers can also gain points by voting for bills that increase government transparency, protect property rights and improve education through structural reform. Where substantial disagreement exists on how best to curtail spending, bills are not considered.

When a legislator has been excused from or did not vote on a bill, its corresponding points are subtracted from the denominator to reflect his or her absence. This has always been Nevada Policy’s approach, and we note its imperfections. However, there has yet to be determined a ‘better’ way of factoring-in absences vis-a-vis lawmakers’ voting records and, for that reason, have no intention of diverting from the status quo.

All scores are expressed as a percentage of the maximum possible number of points. No congressman has ever received a perfect score using the NTU model and so perfect scores should not be expected. Generally, a legislator with a score above 50 is considered to be an ally of economic liberty. Lawmakers with scores above 85+ are considered to be Nevada’s most freedom-loving legislators. (This year, 13 lawmakers—all Republicans—met that threshold.)

Since floor votes are the only objective criteria for evaluating lawmakers’ performance, they are the only factor considered in Nevada Policy’s report rankings. Certain legislative priorities—for example, bills seeking to greatly expand school choice—which never received floor votes cannot be considered by the metric.

For the 2021 session, Nevada Policy identified 54 bills significantly impacting economic liberty that received at least one full-chamber floor vote.

A listing of these bills, and each lawmaker’s voting history, is available here, along with the underlying spreadsheet calculations. Within the spreadsheet, bills are grouped by topic (e.g., transparency, taxes, worker freedom, education, etc…), so citizens can not only review a lawmaker’s overall performance, but also his or her performance within particular areas of interest.

Of the 54 bills whose floor votes were cataloged in Nevada Policy’s legislative report card, 48 were bills that made it to Governor Sisolak’s desk. Each bill before him then demanded a decision: to approve or to veto.

These 48 Sisolak decisions yield a significant and revealing metric for his performance within this responsibility.

It should be noted, of course, that a governor’s influence goes far beyond signing or vetoing legislation. For example, though Governor Sisolak has publicly supported collective-bargaining transparency in the past, he refused to advocate for Assemblyman Matthews’ Assembly Bill 183.

Based upon Sisolak’s unwillingness to veto all but one of the 48 bills Democrats sent to his desk, his performance rating was calculated to be 29.93 percent.

>>>Return to Table of Contents

>>>Return to Table of Contents