Opportunity Scholarships: A Win for Students and Taxpayers

The debate over how best to improve educational outcomes for Nevada students currently stands at a de facto impasse.

On one side, the education establishment argues increased per-pupil funding is necessary to cure what ails the state’s struggling K-12 system. Yet on the other side, taxpayers, already feeling tapped-out by a slew of recent record-breaking tax hikes, are reluctant to give away more of their hard-earned wealth to a system that has consistently underperformed.

But what if there were a proposal that could appeal to the priorities of all interested parties? In other words, what if Nevada could increase the state’s per-pupil investment in public education without increasing the taxpayer burden?

Fortunately, such a proposal exists — educational choice.

Indeed, educational choice programs actually increase per-pupil spending levels without the need for imposing additional layers of taxation.

A just-published NPRI study details the precise fiscal benefits derived from choice programs, focusing specifically on the state’s Opportunity Scholarships program. Its findings should catch the attention of even the most vocal advocates of traditional public schools, because it provides evidence that choice programs actually satisfy one of the education establishment’s key objectives: increased per-pupil funding for children that remain in traditional public schools.

Executive Summary

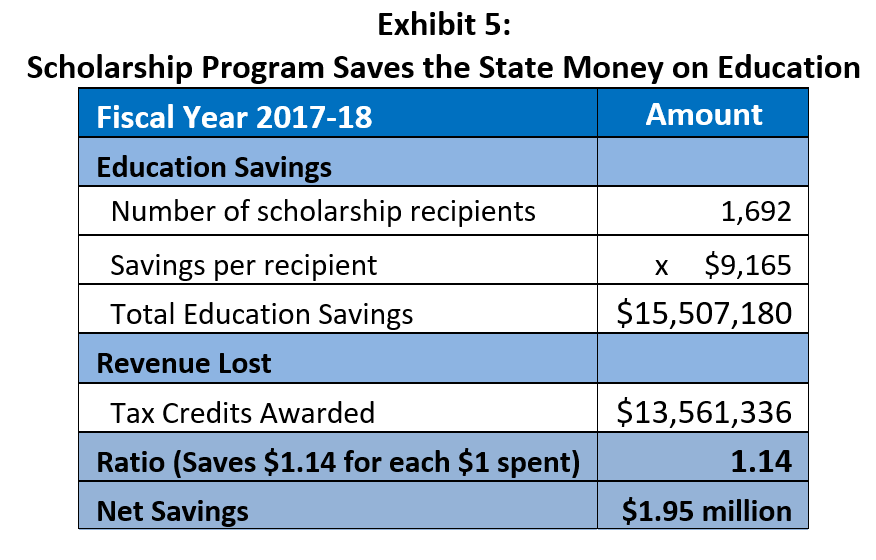

The Nevada Educational Choice Scholarship Program (hereafter the “Opportunity Scholarship” program, as it is more commonly known) produces a net savings to the state. For the current Fiscal Year 2018, we estimate that taxpayers have saved $1.14 in state education funding for every dollar loss in Modified Business Tax (MBT) revenue due to credits for scholarship contributions. We further estimate that, as a greater proportion of approved tax credits are used to finance scholarships, taxpayer savings could increase to $1.92 for every dollar loss in revenue due to tax credits.

Student participation of 1,692 in the scholarship program for the current fiscal year has in effect increased K-12 per-pupil expenditures by about $4, but that number could increase to $27 as additional scholarships are awarded with existing credits. We further assess that expanding student participation to 25,000 (approx. 5% of statewide public school enrollment) could increase per-pupil spending by as much as $235. An increase in per-pupil spending of this magnitude mimics the effects of an additional $116 million in annual education funding.

Similarly, Nevada’s universal Education Savings Accounts program would also generate a net savings to the state, but the program has yet to be funded. Like Opportunity Scholarships, the average value of an ESA would be much less than what the state spends annually on a per-pupil basis, but it is difficult to estimate the fiscal benefits without having access to more information.