Kicking the can down the road, NVPERS shifts cost to future workers

In January of 2010, California outlawed “negative amortization” loans — where the enticingly low starting payments actually drive the borrower further into debt.

Authorities and experts had determined that such practices were predatory, and ultimately harmful to the majority of borrowers who found themselves taking advantage of the loans.

And yet, new data from Moody’s Investors Services reveals that the funding structure of the Nevada Public Employees’ Retirement System (PERS) contains periods of negative amortization — causing precisely the same problem as those allegedly predatory low-payment loans.

It turns out that taxpayers’ record-high $1.437 billion contribution to PERS for the fiscal year ending June 30, 2015 was only 84.5 percent of the “tread water mark” — the amount necessary to pay down at least that year’s growth in interest. As the term indicates, anything over 100 percent would pay both interest and the principal. Anything less than 100 percent of the tread water mark would result in a situation where, because the year’s interest was not entirely paid off, the overall debt actually increases.

For PERS, this means the system’s unfunded liability, by design, would have grown 2.5 percent last year even if its investments had performed perfectly, and the 8 percent annual investment target had been hit!

Because PERS investment returns fell far short of their target last year, however, the actual increase in the unfunded liability will be even greater.

Historically, PERS used a 30-year amortization period to help suppress immediate costs by pushing them onto future generations. While PERS has recently begun moving towards the use of 20-year amortization periods, it is unclear if those reforms will be sufficient to eliminate periods of negative amortization going forward.

This practice violates one of the core principles of public pension plans known as “intergenerational equity” — the concept that today’s costs should not be borne by future generations. By designing public pensions in a way that shifts the cost from current to future public workers and taxpayers, PERS has clearly violated this principal.

This was the conclusion reached by the Society of Actuaries’ Blue Ribbon Panel in 2014, when it found that the 30-year amortization period used by most U.S. public pension plans should be replaced with, “shorter amortization periods,” which, “would tend to improve intergenerational equity,” and “avoid the undesirable accumulation of unamortized principal.”

The panel also called for payments that would “cover interest on unfunded amounts in full and amortize principal” — as opposed to the negative amortization now occurring at PERS.

Because of this negative amortization, Nevada taxpayers would have had to pay 18 percent more — or $1.7 billion — just so PERS could hit their tread water mark. To meet the tread-water mark and pay something towards principal — even just 1 percent of outstanding debt — would have called for a 25 percent hike in Nevada taxpayer contributions, which are already ranked as second highest in the nation.

So why all the gimmicks?

It should be noted that U.S. public pension plans are completely alone in their plan funding and accounting methods — methods that are rejected by 98 percent of professional economists, as well as private U.S. pension plans and both public and private plans in Canada and Europe.

The simplest explanation for why U.S. public pension plans adopt these practices is that they allow for “kicking the can down the road.” It’s much easier to enact legislation bestowing tremendous benefits on plan members, when the real costs of the legislation won’t be seen until 10-20 years down the road.

The single biggest offender in this regard is using an assumed rate of return as the discount rate instead of the liability-based rate that modern finance theory requires. A full discussion on this topic can be found in pages 21-25 of Footprints: How NVPERS, step by step, made Nevada government employees some of the nation’s richest.

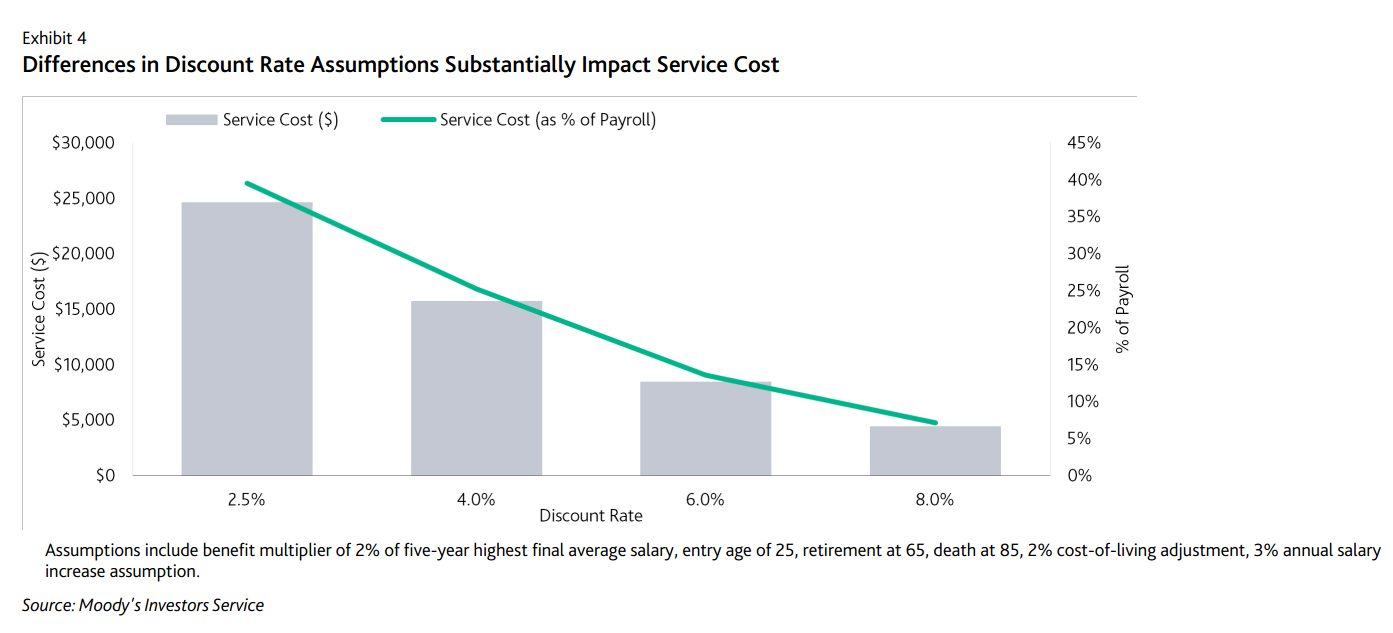

For now, a simple bar chart courtesy of Moody’s Investors Services speaks volumes:

If PERS were to follow the rules governing private U.S. pensions, Canadian and even European plans, the cost to taxpayers would increase approximately five times. In other words, instead of consuming 12 cents of every dollar in combined state and local taxes, retirement costs would gobble up roughly 60 cents of every tax dollar.

Framed in that light, it’s easy to see why defenders of the status quo are reluctant to adopt proper accounting and financial reporting methods. But misrepresenting today’s actual costs only makes the looming balloon payment that much larger — a burden that will, unfairly, be borne by a future generation of government workers.

If negative amortization loans are too dangerous for consumers, then a pension system dependent on similar principles should be considered too dangerous for taxpayers and public employees.