PERS board frustrated with ‘dumbed down’ workforce for questioning rate hikes

As if record-high contribution rates weren’t bad enough, Nevada government workers have another reason to be upset over last year’s PERS rate hike: Contrary to what leadership has claimed, the higher cost provides no additional benefit to the current employees paying it but, instead, is spent exclusively on the system’s multi-billion dollar deficit.

It’s a facet of Nevada’s Public Employee Retirement System (PERS) that adversely impacts every government worker in the state — yet is misunderstood by the very board tasked with running PERS.

Audio recordings of board meetings held by PERS last year indicate that board members fundamentally misunderstand how the system works and, consequently, are seeking to misinform their members too.

During last October’s meeting, Rusty McAllister told fellow board members, “I’ve gotten so many calls…saying, ‘What the hell is going on?” from members frustrated with the latest reduction in their take-home pay — a consequence of yet another PERS rate hike.

McAllister then noted he responds to the callers with: “Hey, that’s before my time!” — at which point the whole board erupted into laughter.

A female voice — most likely PERS executive officer Tina Less — reverted to the underlying subject, citing the need for employers to do a better job educating the “so many” PERS members who are unable to see the “bigger picture.”

“They don’t understand it,” she asserted. “They don’t. They don’t realize that the cut ultimately comes back to them at the point of retirement.”

Unfortunately for PERS members, however, that statement is categorically false — as a simple review of PERS own actuarial reports reveals.

The latest rate hike, just like the one that preceded it, went almost entirely towards previously-accrued debt, not the current member paying it.

But board members, convinced of their own interpretation of the system, completely dismissed the valid concerns being raised by their membership.

Chairman Mark Vincent was exceptionally frustrated that PERS members didn’t share the board’s misunderstanding of how the system works.

“[O]ur workforce is dumbed-down,” he declared. “They don’t think, they don’t have the command of mathematics like they used to. There’s a lot of issues here. Their capacity to understand this stuff is pretty diminished. I’m sorry, it just is.”

Actually, simple elementary-school math shows that Vincent’s assumption about the rate hikes is completely off-base.

In addition to a small, fixed administrative fee, the PERS contribution rate paid by government employees consists of two components: the normal cost and the amortization portion. The normal cost is defined as the “annual cost associated with one year of service accrual,” while the amortization portion is also known as the “past service cost” — that is, the cost of funding benefits for past service.

In layman’s terms, the normal cost is the projected amount needed to cover that member’s future benefit, assuming all assumptions are met. The amortization percentage is the amount spent on the unfunded liability (UAL) — which reflects the funding shortfall created when the assumptions used to fund past workers’ benefits are not met.

Because the portion going toward the UAL provides no benefit to the current member paying it, it is often referred to as a “pension tax.”

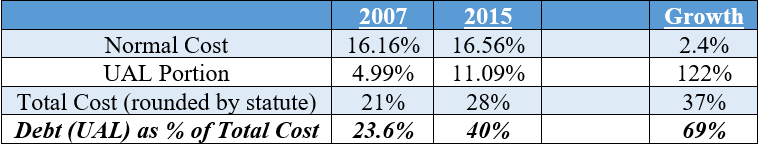

The table below shows what percentage of an employee’s contribution goes toward each component, based on PERS 2007 and 2015 actuarial reports:

Clearly, not only the last rate hike, but every rate hike since 2007 went almost entirely to the unfunded liability — providing no benefit at all to the current members forced to pay this tax.

In addition to the math, this makes intuitive sense as well, as PERS benefits have seen no increases since 2001. Naturally, therefore, there is no reason for a dramatic increase in costs, when the benefit has never increased either.

Instead, what actually took place was a benefit reduction.

All workers hired after 2015 were placed under a reduced benefit system. In other words, these new hires will receive a smaller pension upon retirement than the retirees for whose benefits they are now being taxed to support.

This highlights a remarkable inequity where, all across the U.S., current government workers are being burdened for the past irresponsibility of public pension boards.

In fact, this “pension tax” is now so large that the total cost of PERS will outpace the value of the future pension, regardless of how long an employee works. Consequently, all new hires are expected to be “a net loser in the pension system” — meaning they will receive a retirement benefit worth less than its total cost.

That inequity hits public schools particularly hard, and is expected to “negatively affect current teacher quality and retention,” according to scholars at the Bureau of Labor Statistics.

Making matters worse is the fact that future rate hikes appear inevitable after the PERS board’s carefully chosen consultant — Wilshire Associates — gave the system a mere 29 percent chance of hitting its investment target over the next decade.

It’s a shocking report that may help explain the tension within Nevada.

Members of the Nevada State Education Association, represented by President Ruben Murillo, were so frustrated at PERS refusal to act on the report’s findings — in addition to Vincent’s earlier disparaging comments about PERS members — that they threatened to petition the Nevada Legislature for permission to leave the state system!

The threat was made at a board meeting in May of this year. After Vincent apologized to Murillo for the earlier comments, things appear to have somewhat calmed.

While it remains unclear whether PERS has ever acknowledged what these rate hikes are really used for, one thing is for certain: There are plenty of reasons for PERS members to be upset.

Update: PERS contacted us and said that the comments we attributed to Rusty McAllister were actually made by Board Member Al Martinez and Tina Leiss was actually Board Member Audrey Noriega.