Support for prevailing wage undermines Dem opposition to Opportunity Scholarships

Many lawmakers have argued that the more than $20 million spent on the state’s Opportunity Scholarship Program for low-income students should, instead, go toward traditional public education.

That argument, however, rings hollow given the fact that many of these very same lawmakers have announced support for a bill that, unlike Opportunity Scholarships, actually takes money directly out of the classroom — anywhere from $25 million to nearly $44 million — for a cause far less admirable than helping low-income students receive life-changing scholarships.

Nevada’s Opportunity Scholarship Program offers scholarships to students in households making 300 percent or less of the federal poverty line. The scholarships are funded by donations from Nevada businesses, who in turn receive a tax credit for their donation.

Last session, the Legislature increased the cap on the amount of donations they would allow by $20 million, which saw participation increase to more than 2,300 students.

But that was only a one-time increase, and without the support of Democrats and Governor Sisolak, an estimated 1,000 students will have their scholarships ripped away from them, just a year or two after they made the transition to a new school.

Those who oppose extending the higher donation cap claim that the program takes money away from public education. This is misleading, at best. While the tax credits do reduce the amount of taxes collected by the state, that has no effect on the amount of funding earmarked for education.

Moreover, because the average Opportunity Scholarship is around $5,000, whereas per-pupil spending on public schools is roughly $9,300, each scholarship represents a savings of thousands of dollars for the state — savings that could then be used to increase the per-pupil funding for students who remain in traditional public schools.

However, those opposing Opportunity Scholarships have an even bigger problem than their math. Nevada Democrats, despite worrying about the supposed cost of the scholarship program, have already demonstrated a willingness to support policies that directly take money out of the classroom for causes significantly less important than preventing a massive disruption to the educational experience of mostly low-income and minority children.

Specifically, Assembly Democrats recently introduced AB 136, which schools estimate will cost them $25 million over the next biennium. If the fiscal note from NSHE is included, that amount rises to $43.5 million.

This added cost reflects AB 136’s increase in the so-called “prevailing wage” requirement, which mandates that union workers be paid significantly above-market rates when working on school construction projects.

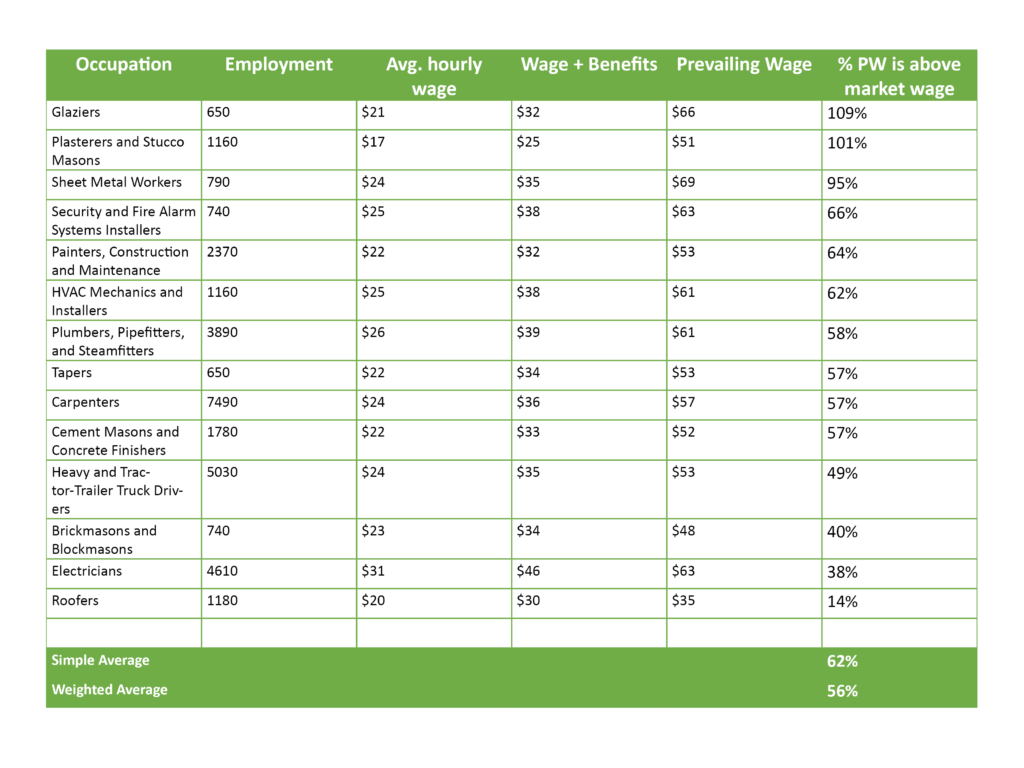

To get a sense of just how inflated these mandated rates are, NPRI analyzed the 2017 prevailing wage rates for 14 job categories in Clark County, which accounted for more than half of all construction employment that year.

The prevailing wage ranged from 14 percent above the market wage for roofers, to a staggering 109 percent above the market wage for glaziers. On a weighted basis, the average Clark County prevailing wage was 56 percent greater than the market wage:

By undoing a modest 2015 reform that made it so schools only had to pay 90 percent of the prevailing wage rate, AB 136 will increase costs by an estimated $25 million over the next biennium — an expense that will be paid for by tax dollars specifically earmarked for education.

Thus, any legislator who supports AB 136 has no grounds on which to object to maintaining the donation cap on the Opportunity Scholarship Program.

If it is okay to take tax dollars out of the classroom to enrich politically connected unions, how can it possibly be wrong to give Nevada businesses a tax break for funding scholarships that help low-income students?