How politicians’ ‘compassion’ delays economic recovery

Although Democrats in the U.S. House of Representatives passed another extension to federal unemployment benefits in May, conservative opponents of deficit spending in both parties have blocked the legislation from moving forward.

Stymied by these efforts, Senator Harry Reid says he hopes to pass the unemployment insurance extension by the Fourth of July weekend.

Unfortunately for advocates of the extension, evidence clearly shows that increasing unemployment benefits makes matters worse. Nevertheless, the debate still rages every time a recession occurs.

Top economists — even within the Obama administration — know that extending unemployment insurance creates more unemployment.

In a 1995 paper, Obama economic advisor Larry Summers observed that "unemployment insurance lengthens unemployment spells." Even the Europe-based Organization of Economic Co-operation and Development (OECD) found that "It is well established that generous unemployment benefits can increase the duration of unemployment spells and the overall level of unemployment …"

Reviewing literature on the subject, Alan Reynolds of the Cato Institute noted that:

- Assistant Secretary of the Treasury for Economic Policy Alan Krueger co-authored a 2002 survey of the topic with Bruce Meyer of the University of Chicago. They found that "unemployment insurance and worker's compensation insurance . . . tend to increase the length of time employees spend out of work."

- Krueger and Andreus Miller of Princeton also found that "job search increases sharply [from 20 minutes a week to 70] in the weeks prior to benefit exhaustion."

- Similarly, Meyer found "the probability of leaving unemployment rises dramatically just prior to when benefits lapse."

- Meyer and Lawrence Katz of Harvard estimated that "a one-week increase in potential benefit duration increases the average duration of the unemployment spells … by 0.16 to 0.20 weeks."

In each case, the economists found that unemployment benefits increase the duration of unemployment.

So it's little surprise that the congressional extension of unemployment benefits from 26 to 99 weeks contributed to rising unemployment. After the Emergency Unemployment Compensation Act was passed in June 2008, it was then renewed or expanded six times, bringing national unemployment as of May to 9.7 percent — about 30 percent higher than the Obama administration had predicted.

Nevada, of course, saw its unemployment rise even further, to 14 percent — highest in the nation. And as the state economy continued to flat-line, Nevada's unemployment fund was exhausted in 2009, leading the state to go $414 million in debt to the federal government by June 17.

By the end of this year, notes Reno journalist Samantha Stone, total state debt incurred from unemployment benefits could be well over a half-billion dollars, reaching $1.8 billion by 2013. Because the Federal Unemployment Tax Act covers only half of the extended unemployment benefits, the federal unemployment extensions are bankrupting the state. Making matters worse, to repay the state's growing debt to the feds, state unemployment taxes next year most likely will rise, further reducing Nevada businesses' ability to create jobs.

Thus, federal government "help" is actually worsening matters on several fronts in Nevada.

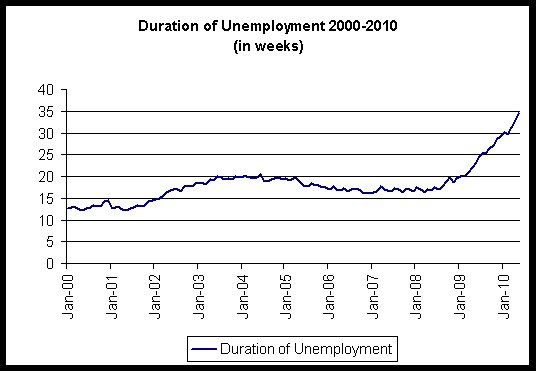

Source: Bureau of Labor Statistics: http://www.bls.gov/webapps/legacy/cpsatab12.htm.

When the Great Recession began in December 2007, the average duration of unemployment was just 16.5 weeks. As of May 2010 the average duration of unemployment stands at 34.4 weeks — a record since the U.S. began tracking the statistic in 1948.

In other words, since the Emergency Unemployment Compensation Act was passed in June 2008, just six months into the recession, the average duration of unemployment has shot up an astounding 17 weeks. The bulk of it — 14 weeks — occurred after the Obama administration, in February 2009, passed the "most expansive anti-recession effort by the United States government since World War II."

Although the recession initially hit the United States harder than Europe, long-term unemployment is a larger problem on the continent precisely because of generous unemployment benefits. While unemployment in the U.S. falls dramatically during economic recoveries, the generous unemployment benefits in Europe encourage Europeans to remain unemployed almost indefinitely. However, in the wake of ill-conceived federal policies, unemployment duration in the U.S. is beginning to more closely resemble that of Europe.

Regularly extending unemployment benefits is a misguided and ineffective way to help the unemployed. The policy not only transfers scarce and badly needed resources away from the productive to the unproductive, it also increases public debt beyond sustainable levels — endangering critical public services — and retards national and state economic recovery.

A solution more compassionate in the long run would be to return to the 26-week maximum for unemployment insurance, while cutting business taxes — allowing firms to expand operation, increase wages and/or hire more workers.

Patrick R. Gibbons is an education policy analyst at the Nevada Policy Research Institute. For more visit http://npri.org/.