Sisolak latest to be enveloped by Nevada’s pension fog

In 2015, the Legislature slashed PERS benefits for all new hires, leaving these workers paying the highest rates in the nation, while receiving the lowest benefits in modern Nevada history.

The following year, teachers were told that they were “idiots, for the most part,” when they complained to the PERS Board over a rate hike that would reduce their salaries, while providing no added benefit of any kind.

This July, a similarly punitive rate hike will reduce teacher salaries again, and just like the several that preceded it, this increase will also go entirely towards paying down PERS debt.

In total, PERS will cost the average Nevada teacher an estimated $17,253 next year — almost half of which will be spent on already earned and promised benefits, rather than the teacher’s own future benefit.

This means that the average Nevada teacher is losing nearly $7,700 a year to pay for other people’s retirement.

In addition to eliciting complaints from PERS members themselves, such an obviously unfair and inefficient system has been sharply criticized from experts across the ideological spectrum, including those with Bellwether Education Partners, the Brookings Institution, the federal Bureau of Labor Statistics, and the left-leaning Urban Institute.

Yet, the Legislature has consistently rejected all reform efforts, including one that would have actually increased the benefits of most members.

Why?

The most likely culprit is the inherent complexity of PERS, which causes many to misunderstand how the system works.

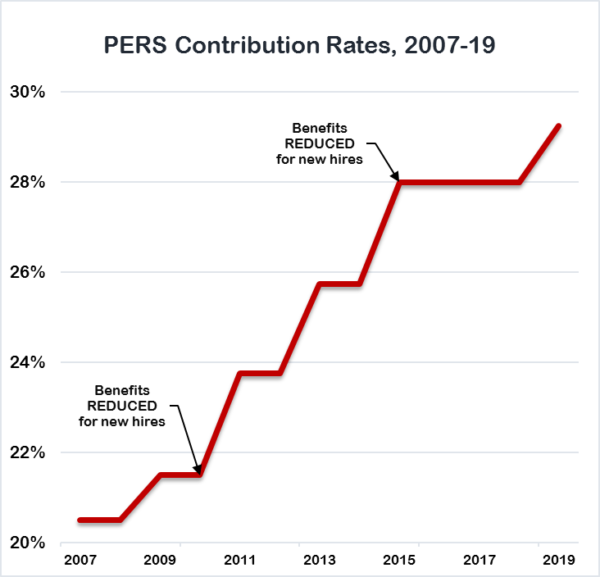

Some media reports, for example, have erroneously suggested that PERS unfunded liability is essentially a meaningless figure. In reality, the cost of paying down PERS unfunded liability is why contribution rates have increased nearly 50 percent over the past decade, as benefits remained flat or, in the case of recent hires, were slashed to record lows.

This confusion has spread to lawmakers as well.

Last year, Interim Retirement and Benefits Committee Chair Maggie Carlton suggested that higher wages for state workers was a viable way to reduce PERS unfunded liability. Shockingly, PERS Executive Officer Tina Leiss encouraged this misunderstanding, rather than explaining how that would only make matters worse.

No wonder Governor Sisolak mistakenly described PERS as the nation’s best-funded plan when he sat down for an in-depth interview with Jon Ralston last month.

But even under the most favorable assumptions, PERS only ranks 21st out of the 50 states. When measured as a percent of state GDP, Nevada’s pension debt is the ninth largest nationwide, according to the Federal Reserve System.

Nevadans will send roughly $2.1 billion to PERS next year — an amount equal to nearly half of the entire State General Fund. Forty five percent of that will be spent exclusively on debt, which provides no value of any kind to the teacher, taxpayer or other public employee responsible for paying this cost.

Given its enormous cost, and negative effect on teacher quality and recruitment, it is imperative that lawmakers have complete and accurate information about how PERS really works.

That information makes clear that the status quo is harming both taxpayers and public employees alike. Lawmakers should consider adopting a retirement system where teachers receive the full benefit of their contributions, instead of requiring them to pay a 45 percent tax to fund the much richer benefits received by the previous generation of workers.

The successful reforms already passed by Arizona, Michigan, Utah and the federal government are a great starting point for lawmakers interested in exploring potential reform options.